By the way, although this article is really about you charging money on your credit cards, we also talk about how to handle the tricky problem of your customers paying with credit cards.

How to track business credit cards in QuickBooks 2021

If you want to track credit card spending and balances with QuickBooks, you need to set up a credit card account—if you didn’t already do so in QuickBooks Setup. (By comparison, you use bank accounts to track things such as the money that flows into and out of a checking, savings, or petty-cash account.)Setting up a credit card account

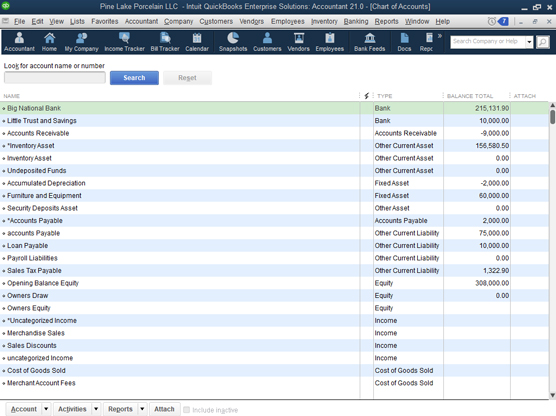

To set up a credit card account, you follow roughly the same steps that you use to set up a bank account:1. Choose Lists→Chart of Accounts.

Or click the Chart of Accounts icon on the home screen. QuickBooks displays the Chart of Accounts window, as shown.

The Chart of Accounts window

The Chart of Accounts window2. Click the Account button in the bottom-left corner of the Chart of Accounts window and then choose New from the drop-down menu.

QuickBooks displays the first Add New Account window, which simply displays a list of option buttons corresponding to the different types of accounts QuickBooks allows.

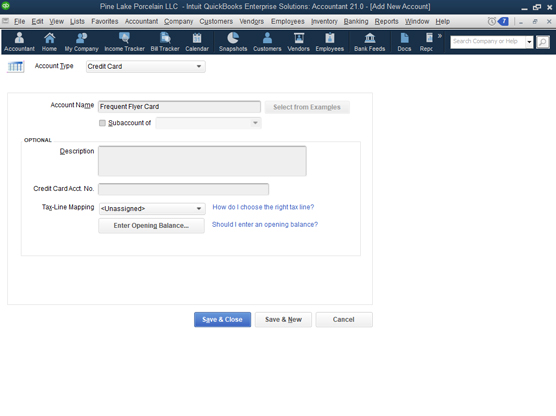

3. Select the Credit Card option.Selecting Credit Card tells QuickBooks that you want to set up a credit card account. I’m sure that you’re surprised. Click Continue. QuickBooks displays the second Add New Account window, as shown.

The second Add New Account window

The second Add New Account window4. Type a name for the account in the Account Name text box.

Why not do it right? Move the cursor to the Account Name text box and then enter the name of your credit card.

5. Type the card number in the Credit Card Acct. No. text box.If you’re creating a general credit card account for more than one card, leave the Credit Card Acct. No. text box empty. While you’re at it, you can describe the card, too. You may want to type Usury! in the Description text box, depending on your card’s interest rate.

6. Click the Save & Close button.QuickBooks redisplays the Chart of Accounts window. Now the window lists an additional account: the credit card account that you just created.

Selecting a credit card account so that you can use it

To tell QuickBooks that you want to work with a credit card account, you use the Chart of Accounts window. Choose Lists→Chart of Accounts. After you display the window, double-click the credit card account that you want to use. QuickBooks displays the Credit Card register so that you can begin recording transactions.As an alternative to the Chart of Accounts window, you can click the Enter Credit Card Charges icon in the Banking area of the home screen. Or you can choose Banking→Enter Credit Card Charges.

Entering credit card transactions

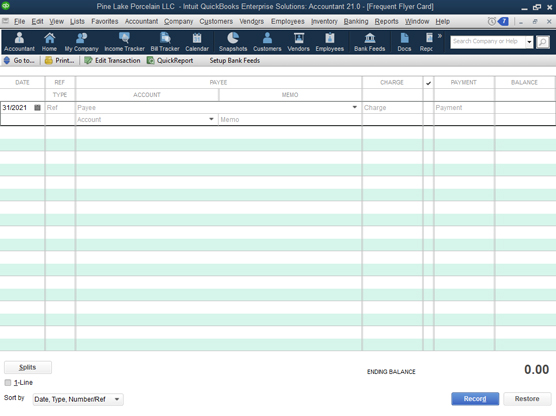

If you choose the Banking→Use Register command and select a credit card account, QuickBooks displays the Credit Card register. This figure shows the register for a credit card account named Frequent Flyer Card. It looks a lot like a Checking register, doesn’t it? The Credit Card register

The Credit Card registerThe Credit Card register works like the regular register window that you use for a checking account. You enter transactions in the rows of the register. When you record a charge, QuickBooks updates the credit card balance and the remaining credit limit.

Recording a credit card charge

Recording a credit card charge is similar to recording a check or bank account withdrawal. For the sake of illustration, suppose that you charged $75 worth of burritos and margaritas to your favorite Mexican restaurant, La Cantina. Here’s how you record this charge:1. Choose Banking→Enter Credit Card Charges.

The Enter Credit Card Charges window appears, as shown.

The Enter Credit Card Charges window

The Enter Credit Card Charges window2. From the Credit Card drop-down menu, choose the credit card that you charged the expense against.

Click the down arrow next to the Credit Card field and then choose a card from the drop-down menu.

3. In the Purchased From box, record the name of the business that you paid with a credit card.Move the cursor to the Purchased From line, and click the down arrow. You see a menu of names. Choose one from the menu.

If you’ve never dined at this fine establishment before, choose Add New; then add the business name.

4. Select the appropriate option button to indicate whether the transaction is a purchase or a credit.Select the Purchase/Charge option button if you want to record a purchase (which is what you do most of the time and what this example shows you). Select the Refund/Credit option button if you want to record a credit on your account (if you returned something, for example).

5. Enter the charge date in the Date field.Move the cursor to the Date line (if the cursor isn’t already there), and type the date, using MM/DD/YYYY format. Type either 07012021 or 7/1/21 for July 1, 2021, for example. If you’re entering this charge two or three days after the fact, don’t enter today’s date; enter the date when the charge was made. Using that date makes reconciling your records with your credit card company’s records easier when you get your monthly statement.

6. Type the charge amount in the Amount box.Move the cursor to the Amount line, and enter the total charge amount. Note: Don’t type a dollar sign, but do type the period to indicate the decimal place.

7. (Optional) Enter a memo description in the Memo text box.Move the cursor to the Memo text box, and type the specific reason why you’re charging the item. In this case, you could type "Attorney/CPA Lunch" or something like that.

Wait. You know what? Let me be more serious. No joking for a minute, okay? This Memo box is a good place to document the business purpose for a charge, which is a tax-law requirement if you’re recording a travel, meal, or entertainment business credit card charge.

8. Fill in the Expenses tab.You use the Expenses tab to record business expenses.

Move to the Account column of the Expenses tab, click the down arrow, and choose an Expense account from the menu (most likely Travel & Ent:Meals for a business lunch). If you enter a name here that QuickBooks doesn’t already know, it asks you to set up an expense account.

QuickBooks automatically fills in the Amount column when you enter a sum in the Amount field. Type something in the Memo column, and assign this expense to a Customer:Job and Class if you want to. You need to turn on class tracking if you want to assign the expense to a class.

9. Fill in the Items tab.Because this charge is for a meal at a restaurant, you don’t itemize the charge. If you were charging inventory items such as lumber, paper supplies, and so on, however, you’d fill in the Items tab.

If you have a purchase order (PO) on file with the vendor that you entered in the Purchased From line, QuickBooks tells you so. Click the Select PO button to see a list of your outstanding POs with the vendor.

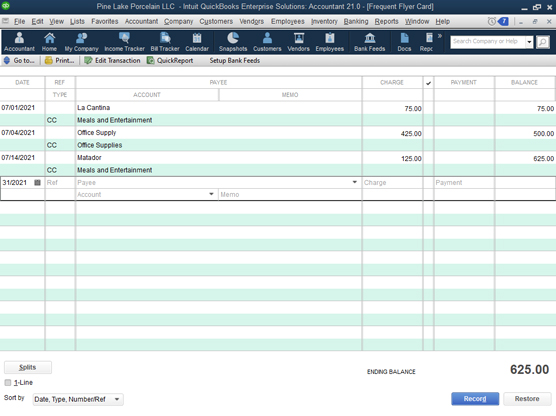

10. Record the charge by clicking the Save & New button or the Save & Close button.The charge is recorded in the Credit Card register. This figure shows what the Credit Card register looks like after you enter a handful of charges.

The Credit Card register with some transactions

The Credit Card register with some transactionsChanging charges that you’ve already entered

Perhaps you record a credit card charge and then realize that you recorded it incorrectly. Or perhaps you shouldn’t have recorded it at all because you didn’t pay for the business lunch. (Someone else paid for it after one of those friendly arguments about who should pay the bill. You know the type of argument I mean: “No, I insist.” “On the contrary, I insist.” You get the picture.)You have to go into the Credit Card register and edit or delete the charge by following these steps:

1. Choose Lists→Chart of Accounts.

You see the Chart of Accounts window.

2. Double-click the credit card account where the faulty charge is.Like magic, the Credit Card register appears onscreen.

3. Select the credit card transaction that you want to delete or change.That’s easy. Just move the cursor to the transaction.

4. Void, delete, or edit the transaction, as follows:-

- To void the credit card transaction, choose Edit→Void Credit Card Charge and then click OK.

- To delete the transaction, choose Edit→Delete Credit Card Charge. QuickBooks displays a message box that asks whether you really want to delete the transaction. Click OK.

- To edit the transaction, click the Edit Transaction button on the ribbon at the top of the window. You return to the Enter Credit Card Charges window. Make your changes there and then click Save & New or Save & Close. You also can make changes inside the Credit Card register and click Record when you’re done.

How to reconcile your credit card statement and pay the bill

You reconcile, or balance, a credit card account the same way you balance a bank account. After you get the account to balance and click Reconcile Now, QuickBooks displays the Make Payment dialog box, asking how you want to pay the bill. You can pay by check or enter a bill to be paid later. (The second option is the accounts payable method.)If you opt to pay the bill by writing a check, you go straight to the Write Checks window, and the Expenses tab is all filled out for you. Fill in the name of the card issuer, the date, and so on. Click Save & New or Save & Close when you’re done. The payment is recorded in both the Checking register and the Credit Card register because you charge the credit card liability account with the check total.

If you opt to enter the payment as a bill to be paid at a later date, you go to the Enter Bills window. Fill everything out just as you would if you were in the Write Checks window. When you click Save & New, the transaction is recorded in the Accounts Payable register and the Credit Card register.

So, what about debit and ATM cards?

Debit and ATM cards, when you get right down to it, aren’t credit cards at all. Using a debit card or an ATM card is more akin to writing a check than anything else. Rather than withdrawing money by writing a check, however, you withdraw money by using a debit card (which is what I call this type of card from here on in).Although a debit card transaction sometimes looks (at least to your friends and the merchants you shop with) like a credit card transaction, you should treat a debit card transaction the way you treat a check. In a nutshell, here’s what you need to do:

- When you charge something to a debit card, record the transaction just like you record a regular check. You may want to enter the transaction number as the check number or in the Memo line so that you can keep track of the transaction.

- When you withdraw cash by using a debit card, record the transaction as a regular withdrawal (or transfer to a petty-cash account), as though you went to the bank with a withdrawal slip.

- When you make a deposit through a cash machine by using a debit card, record the transaction just like you record a regular deposit.

So, what about customer credit cards?

I want to talk about an awkward subject before you and I close our discussion of how to work with credit cards. Here, I talk about—gulp—how to handle customer credit card payments.Okay, if you don’t already know this, although your customers probably love to pay you with credit cards, customer credit cards create a headache for you. The reason is that your merchant bank or credit card processor aggregates customer credit card charges and then — maybe on a daily basis or maybe every few days — deposits a big wad of cash in your bank account. The cash represents the sum of the recent credit card charges minus a fee (which I hope is modest).

This all sounds innocuous enough, but here’s an example of how it works. Customers A, B, and C come in on Monday and spend $5, $10, and $15, respectively. Then, on Tuesday, customers D, E, and F come in and spend $10, $50, and $30, respectively. On Wednesday, you don’t sell anything to someone who uses a credit card, but you do see a $105 deposit in your bank account by the credit card company.

The problem is that you’re looking at the last two days’ worth of credit card transactions, and you know that they total $120 because that’s the total you sold to customers A, B, C, D, E, and F. So what’s with the $105? Is the missing $15 a service fee? Oh, no, wait. Maybe Customer A called his credit card company and blocked that first $5 charge. Or maybe it was Customer B?

If you accept a credit card, you know how this works, right? It’s a royal headache.

I think you probably have two reasonable approaches for dealing with this madness:

- The Good Accountant’s Way: You can record customer credit card payments in the usual way — the way that QuickBooks expects. The Good Accountant’s Way produces nice, accurate records, but at the cost of enormous bookkeeping hassles. Interested in more information? Great! Use the QuickBooks Help command to search QuickBooks online help for the topic recording a credit card payment.

- The Bad Accountant’s Way: You can just record sales receipt transactions when the credit card company deposits net charges amounts in your bank account. In other words, using the example numbers given in an earlier paragraph, rather than recording individual transactions for customers A, B, C, D, E, and F when the sales occur, you can record a $105 transaction when the credit card company deposits $105 into your bank account. If you know the credit card company’s service charge, you can record that, too, using a journal entry. (You’ll probably want to ask your accountant for help on this.)