Traditionally, you buy a license to use software that you install on your computer, and typically, that license permits you to install the software on only one computer.

And, of course, a QBO user can pay varying amounts for a subscription, depending on the subscription level purchased.QBO is available at five different subscription levels, and each subsequent subscription level costs more and contains more functionality. The QBO subscriptions available at this writing are:

- Self-Employed

- Simple Start

- Essentials

- Plus

- Advanced

All versions of QBO share three attributes in common. First, you can use a tablet, Android or iOS smartphone, or desktop computer to access your data. Second, your data is automatically backed up online. And third, all versions of QBO use 128-bit Secure Sockets Layer (SSL), the same security and encryption used by banks to secure data sent over the internet.

After you assess your needs, use the following information to identify the lowest subscription level that will meet your requirements. At this point in time, you can upgrade to a higher level, but you cannot downgrade to a lower level.Accounting professionals signing up clients for QBO and creating client companies originally couldn’t switch client companies from one version of QBO to another if the accounting professional created the client as part of the Intuit Wholesale Pricing program. However, except for the Self-Employed version, that’s no longer true. So, you no longer need to anticipate your client’s requirements for more advanced features like the ability to track inventory or employing class tracking.

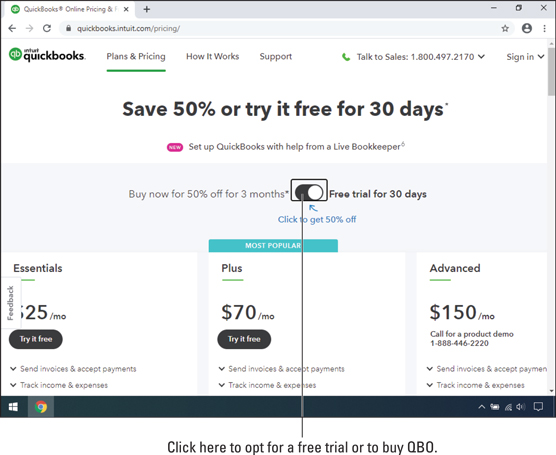

Use the slider to toggle between a short-term discount or a free trial.

Use the slider to toggle between a short-term discount or a free trial.The QBO Self-Employed version

This version of QBO is aimed at freelancers and self-employed individuals, basically, those who receive Federal Form 1099 to account for the money they’ve been paid and pay their taxes using Schedule C of IRS Form 1040. Be aware, though, that the QuickBooks Self-Employed version (QBSE) is not currently part of the QBO product line, and that means that you cannot upgrade from QBSE to any other QBO product directly—an important fact to keep in mind when deciding to start with QBSE. If your business has business bank accounts, you should not use the Self Employed version. QBSE enables you to separate personal and business expenses and mileage, so it’s really geared to the “side hustle” gig economy, like Uber and Lyft drivers.Using the Self-Employed version, you can:

- Download transactions from your bank and credit card accounts.

- Separate business from personal spending.

- Create and send invoices at any time, and personalize your invoices using your logo as well as customize the subject line and main message of the invoice email.

- Send a mobile reminder to customers before payment is due; and, QBSE lets you know when your invoice is viewed and paid.

- Send receipts for paid invoices.

- Duplicate prior invoices to send them again, eliminating busy work.

- Accept mobile payments and take advantage of free bank transfers.

- Track mileage using your phone’s GPS and delete trips, along with mileage, in bulk.

- Use your phone to take photos of receipts for your expenses; QBSE automatically extracts key data from the receipt and uses the information to match an existing transaction or to create a new expense.

- Use QBSE’s Expense Finder feature to identify more potential deductions by securely connecting your bank accounts to pull in business expenses from the entire past year and sort them into Schedule C categories. When you sign in to QBSE for the first time from March 20 to April 15, select “No, I am still working on 2020 taxes” to access the Expense Finder feature. You can then connect to your bank accounts to securely import all 2020 expenses in just minutes. The Expense Finder feature automatically finds work expenses and organizes them by Schedule C category.

- Calculate and pay estimated quarterly taxes.

- Use QBSE Labs to test drive new features.

- If you need more guidance or have loyalties to a tax preparer, you can invite your tax preparer to work with your QBSE data using QBOA.

If you opt to include TurboTax in your subscription, you also can pay your estimated quarterly taxes online and export Schedule C information from QBO to TurboTax so that you can prepare your tax return more easily. With TurboTax as part of your subscription, you receive one federal and one state electronic tax return filing at no extra cost.

The Simple Start version

The Simple Start version of QBO is great for a new business with basic bookkeeping needs. With Simple Start, you can:- Track your income and expenses.

- Download transactions from your bank and credit card accounts.

- Create an unlimited number of customers.

- Send unlimited estimates and invoices.

- Print checks and record transactions to track expenses.

- Track and pay sales taxes.

- Track, create, and send 1099-Misc forms.

- Import data from Microsoft Excel or QuickBooks Desktop.

- Invite up to two accountants to access your data.

- Integrate with available apps in QBO’s App Center.

Although the Simple Start version allows two accountants to work in the client’s company, Simple Start is still designed for a single user. Therefore, the accountant cannot create the client’s company for the client. At the time the company is created in QBO, whoever creates the company becomes, in QBO parlance, the Master Administrator.

In addition to the single-user restriction, the Simple Start version offers more than 50 reports. And Simple Start users can memorize report settings and produce memorized reports. Use this link to purchase QuickBooks Simple Start.

For subscription levels that support multiple users, the accountant can create the company for the client and then assign the master administrator role to the client. And, if the accountant doesn’t make the client the master administrator when creating the company, the accountant can, later on, transfer the master administrator role to the client.

The Essentials version

The Essentials version of QBO includes all the features found in Simple Start. In addition, with the Essentials version, you can:- Set up invoices to automatically bill on a recurring schedule.

- Take advantage of Accounts Payable functions, including entering vendor bills and scheduling their payment for later.

- Create and post recurring transactions.

- Track time.

- Control what your users can access.

The Plus version

The Plus version of QBO is the most full-featured version of QBO. It contains all the features found in the Essentials version. In addition, you can:- Create, send, and track purchase orders.

- Track inventory using the first in, first out (FIFO) inventory valuation method. QBO supports light inventory needs: If you sell finished goods, QBO should be able to manage your needs. But if you need to assemble finished goods to sell, QBO won’t meet your needs on its own. You can look for an add-on app to supplement your inventory needs.

- Categorize income and expenses using class tracking.

- Track sales and profitability by business location. You can assign only one location to a transaction, but you can assign multiple classes to a transaction.

- Give employees and subcontractors limited access to the QBO company to enter time worked.

- Track billable hours by customer. QBO supports light job-costing needs, but it does not allow you to automatically cost labor.

- Track projects.

- Create budgets to estimate future income and expenses, and you can create multiple budgets per year, location, class, or customer.

The Advanced version

Intuit has recently started offering QBO Advanced, a version aimed at users who have outgrown QBO Plus. In addition to all of the features you find in QBO Plus, using QBO Advanced, you can:- Have up to 25 simultaneous users with full access.

- Connect with a dedicated Customer Success Manager to handle support questions; support calls go to the front of the line instead of waiting in queue. Customer Success Managers also provide information on online training and QuickBooks products; subscribers to QBO Advanced are entitled to five free online training courses annually.

- Establish custom permissions for your users.

- Efficiently import hundreds of invoice transactions created outside of QuickBooks through a CSV file at one time.

- Enable workflows to trigger reminders for customers and internal team members.

- Utilize up to 48 custom fields.

- Implement the included online backup service, which allows you to back-up and restore your accounting data.

- Batch create transactions, including invoices, bills, checks, and expenses.

- Visualize your data in the Performance Center with customizable chart widgets.

- Take advantage of enhanced reporting capabilities called Smart Reporting, powered by Fathom.