All option strategies (whether simple or sophisticated), when broken down, are made up of simple call and/or put options.

How to read an option

To answer Series 7 questions relating to options, you have to be able to read an option. The following example shows you how an option may appear on the Series 7:Buy 1 XYZ Apr 60 call at 5Here are the seven elements of the option order ticket and how they apply to the example:

- Whether the investor is buying or selling the option: Buy When an investor buys (or longs, holds, or owns) an option, she is in a position of power; that investor controls the option and decides whether and when to exercise the option. If an investor is selling (shorting or writing) an option, she is obligated to live up to the terms of the contract and must either purchase or sell the underlying stock if the holder exercises the option.

- The contract size: 1 You can assume that one option contract is for 100 shares of the underlying stock. Although this idea isn’t as heavily tested on the Series 7 exam, an investor may buy or sell multiple options (for example, five) if she’s interested in having a position in more shares of stock. If an investor owns five option contracts, she’s interested in 500 shares of stock.

- The name of the stock: XYZ In this case, XYZ is the underlying stock that the investor has a right to purchase at a fixed price.

- The expiration month for the options: Apr All options are owned for a fixed period of time. The initial expiration for most options is 9 months from the issue date. In the preceding example, the option will expire in April. Options expire on the third Friday of the expiration month. This entire warning needs to be removed. Options used to expire on Saturday, now it’s Friday.

- The strike (exercise) price of the option: 60 When the holder (purchaser or owner) exercises the option, she uses the option contract to make the seller of the option buy or sell the underlying stock at the strike price (see the next step for info on determining whether the seller is obligated to buy or sell). In this case, if the holder were to exercise the option, the holder of the option would be able to purchase 100 shares of XYZ at $60 per share.

- The type of option: call An investor can buy or sell a call option or buy or sell a put option. Calls give holders the right to buy the underlying security at a set price; puts give holders the right to sell. So in the example scenario, the holder has the right to buy the underlying security at the price stated in the preceding step.

- The premium: 5 Of course, an option investor doesn’t get to have the option for nothing. An investor buys the option at the premium. In this case, the premium is 5, so a purchaser would have to pay $500 (5 × 100 shares per option).

Call options: The right to buy

A call option gives the holder (owner) the right to buy 100 shares of a security at a fixed price and the seller the obligation to sell the stock at the fixed price. Owners of call options are bullish (picture a bull charging forward) because the investors want the price of the stock to increase. If the price of the stock increases above the strike price, holders can either exercise the option (buy the stock at a good price) or sell the option for a profit. By contrast, sellers of call options are bearish (imagine a bear hibernating for the winter) because they want the price of the stock to decrease.

For example, assume that Ms. Smith buys 1 DEF October 40 call option. Ms. Smith bought the right to purchase 100 shares of DEF at 40. If the price of DEF increases to over $40 per share, this option becomes very valuable to Ms. Smith, because she can purchase the stock at $40 per share and sell it at the market price or sell the option at a higher price.If DEF never eclipses the 40 strike (exercise) price, then the option doesn’t work out for poor Ms. Smith and she doesn’t exercise the option. However, it does work out for the seller of the option, because the seller receives a premium for selling the option, and the seller gets to pocket that premium.

Put options: The right to sell

You can think of a put option as being the opposite of a call option (see the preceding section). The holder of a put option has the right to sell 100 shares of a security at a fixed price, and the writer (seller) of a put option has the obligation to buy the stock if exercised. Owners of put options are bearish because the investors want the price of the stock to decrease (so they can buy the stock at market price and immediately sell it at the higher strike price or sell their option at a higher premium). However, sellers of put options are bullish (they want the price of the stock to increase), because that would keep the option from going in-the-money (see the next section) and allow them to keep the premiums they received.

For example, assume that Mr. Jones buys 1 ABC October 60 put option. Mr. Jones is buying the right to sell 100 shares of ABC at 60. If the price of ABC decreases to less than $60 per share, this option becomes very valuable to Mr. Jones. If you were in Mr. Jones’s shoes and ABC were to drop to $50 per share, you could purchase the stock in the market and exercise (use) the option to sell the stock at $60 per share, which would make you (the new Mr. Jones) very happy.If ABC never drops below the 60 strike (exercise) price, then the option doesn’t work out for Mr. Jones and he doesn’t exercise the option. However, it does work out for the seller of the option, because the seller receives a premium for selling the option that she gets to keep.

Options in-, at-, or out-of-the-money

To determine whether an option is in- or out-of-the-money, you have to figure out whether the investor would be able to get at least some of his or her premium money back if the option were exercised.You can figure out how much an option is in-the-money or out-of-the-money by finding the difference between the market value and the strike price.

Here’s how you know where-in-the-money an option is:- When an option is in-the-money, exercising the option lets investors sell a security for more than its current market value or purchase it for less — a pretty good deal.

The intrinsic value of an option is the amount that the option is in-the-money; if an option is out-of-the-money or at-the-money, the intrinsic value is zero.

- When an option is out-of-the-money, exercising the option means investors can’t get the best prices; they’d have to buy the security for more than its market value or sell it for less. Obviously, holders of options that are out-of-the-money don’t exercise them.

- When the strike price is the same as the market price, the option is at-the-money; this is true whether the option is a call or a put.

A put option — the right to sell — goes in-the-money when the price of the stock drops below the strike price. For example, a TUV 80 call option is in-the-money when the price of TUV drops below 80. The reverse holds as well: If a put option is in-the-money when the price of the stock is below the strike price, it must be out-of-the-money when the price of the stock is above the strike price.

Don’t take the cost of the option (the premium) into consideration when determining whether an option is in-the-money or out-of-the-money. Having an option that’s in-the-money is not the same as making a profit. (See the next section for info on premiums.)

Use the phrases call up and put down to recall when an option goes in-the-money. Call up can help you remember that a call option is in-the-money when the market price is up, or above the strike price. Put down can help you remember that a put option is in-the-money when the market price is down, or below the strike price.

When someone purchases an option, it is said that he is long the option. An investor who is long an option is paid the premium for the option so he needs the option to go in-the-money (the price of the underlying security to go in the correct direction) enough for him to not only recoup his premium but also make a few bucks.

When someone is short an option, it means that he sold the option. This person is on the opposite side of the transaction than the person who is long the option. In this case, the seller received a premium for selling the option. So someone who is short an option is doing so for income and is hoping that the option expires out-of-the-money so that he gets to keep the premium.Pay the premium: The cost of an option

The premium of an option is the amount that the purchaser pays for the option. The premium may increase or decrease depending on whether an option goes in- or out-of-the-money, gets closer to expiration, and so on. The premium is made up of many different factors, including- Whether the option is in-the-money

- The amount of time the investor has to use the option

- The volatility of the underlying security

- Investor sentiment (for example, whether buying calls on ABC stock is the cool thing to do right now)

P = I + TIn this formula, P is the premium or cost of the option, I is the intrinsic value of the option (the amount the option is in-the-money), and T is the time value of the option.

For example, here’s how you find the time value for a BIF Oct 50 call option if the premium is 6 and BIF is trading at 52: Call options (the right to buy) go in-the-money when the price of the stock goes above the strike price. Because BIF is trading at 52 and the option is a 50-call option, it’s two points in-the-money; therefore, the intrinsic value is 2. Because the premium is 6 and the intrinsic value is 2, the premium must include 4 as a time value:

P = I + TThe following question tests your knowledge of using the formula P = I + T.6 = 2 + T

T = 4

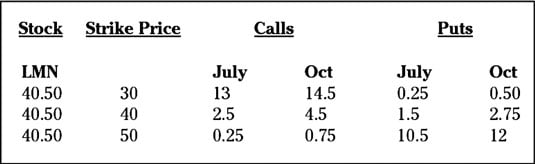

Use the following chart to answer the next question.

What is the time value of an LMN Oct 30 call?Using the chart, the first column shows the price of the stock trading in the market, the second column shows the strike prices for the options, and the rest of the chart shows the premiums for the calls and puts and the expiration months. Scan the chart under the October calls, which is in the fourth column; then look for the 30-strike price, which is in the first row of data. The column and row intersect at a premium of 14.5.(A) 2.5

(B) 4

(C) 6.25

(D) 9.5

The answer you’re looking for is Choice (B). This chart is similar to what you may see on the Series 7 exam. Most of the exhibits you get on the Series 7 are simple, and solving the problem is just a matter of locating the information you need.

Now you need to find the intrinsic value (how much the option is in-the-money). Remember that call options go in-the-money when the price of the stock is above the strike price (call up). This is a 30-call option and the price of the stock is 40.50, which is 10.5 above the strike price. Plug in the numbers, and you find that the premium includes a time value of 4:

P (premium) = I (intrinsic value) + T (time value)14.5 = 10.5 + T

T = 4