Two of the questions are multiple-part questions. For these two questions, you choose one of two opposing answer choices for each of three statements. The other question is a five-option multiple-choice question, for which you must select the one best answer choice.

In the following practice exercise, you must answer a multiple-part question.

Practice exercise

Use the following information to answer both questions.Incentive Program (Tab 1)

Radio station WXXX is owned by Allmedia Investments, Inc. WXXX generates revenue by selling advertising air time. However, due to competition from the internet, television, newspapers, and other radio stations, bringing in advertising dollars is a competitive challenge for WXXX.

To sustain station profitability, WXXX station manager, Rock Talley, with guidance from Kathy Chen, Allmedia's chief financial officer, created an incentive program to increase annual first-quarter revenues. Under the program, current clients who increase their first-quarter advertising dollars by an additional $25,000 receive an all-expenses-paid 12-day tour of Spain for two people. New clients must purchase $25,000 of advertising to be eligible.

The first quarter of the program ran from January 1 to March 31 of the current year. Throughout the quarter, each client received advertising air time for the $25,000. The cost to WXXX for the trip to Spain was $3,500 for each of the two people, for a total of $7,000 per client.

Talley Memo to Chen (Tab 2)

From: Rock Talley, WXXX Station Manager

To: Kathy Chen, CFO, Allmedia Investments, Inc.

I have two primary concerns about the WXXX advertising incentive program. First, I suspect that clients are purchasing advertising air time that they don't need in order to obtain the paid trip to Spain. One couple, who has a family-owned business, told me pointblank that the station's offer induced them to buy the additional advertising. I'm worried that we may be encouraging clients such as this one, who have small businesses and do not employ a paid financial manager, to make unsound business decisions.

Second, based on the results from the first quarter (see the attached table), the incentive program does not appear to be cost-effective. WXXX pays the full cost of $7,000 for the trip to Spain, and it requires a minimum of $10,000 to cover the advertising air time costs for the time sold in the incentive package to the client. Thus, we need $17,000 in additional monies from each incentive program participant to break even from the program. We should be realizing a net profit of $8,000 per client participant. However, in actuality, because our sales personnel offered reduced rates to current clients that had quarterly contracts, only a few clients paid the full $25,000 that was necessary for program eligibility.

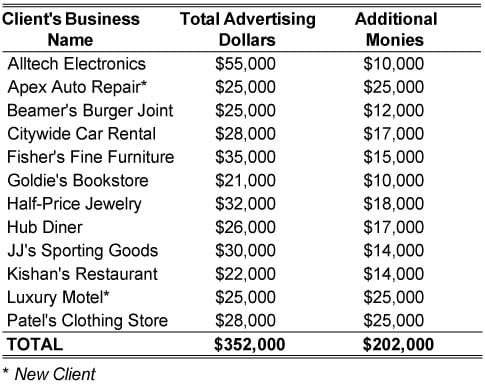

Table: First Quarter Incentive Program (Tab 3)

The table shows the business name of each client who participated in the incentive program during the first quarter, the total amount of advertising dollars received from the client upon accepting the station's trip offer, and the amount of these advertising dollars that are additional monies not already accounted for in a quarterly contract with the client.

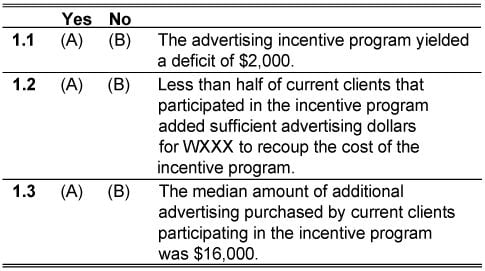

- For each of the following statements, select Yes if the statement is true based on the given information. Otherwise, select No.

Answers and explanations

1.1. The correct answer is A.

According to Talley's memo to Chen, the radio station needed $17,000 in additional monies from each incentive program participant to break even. According to the table, there were 12 program participants. To break even, a total of

in additional monies was needed from these clients. The table shows that the station obtained a total of $202,000 in additional monies from these 12 clients, resulting in a deficit of $204,000 – $202,000 = $2000. Therefore, the statement is true, and the correct answer is Yes.

1.2. The correct answer is A.

Talley's memo states the radio station needed $17,000 in additional monies from each incentive program participant to break even. The table shows that only four of the 10 current clients met that minimum. Therefore, the statement is true, and the correct answer is Yes.

1.3. The correct answer is B.

The median amount of additional advertising purchased by current clients participating in the incentive program was $14,500, not $16,000. Therefore, the statement is false, and the correct answer is No.