Dividends are paid based on how many shares you own or dividends per share (DPS). If a company declares a $1 per share dividend and you own 100 shares, you will receive $100. To help compare the sizes of dividends, investors generally talk about the dividend yield, which is a percent of the current market price.

A company's net profits can be kept within the company as retained earnings. A company may also choose to use net profits to repurchase their own shares in the open markets in a share buyback. Dividends and share buy-backs do not change the basic value of a company's shares. Dividends must be approved by the shareholders and may be a one-time pay out, or as an ongoing cash flow to owners and investors.

Start-ups and some high-growth companies such as those in the technology or biotechnology sectors rarely offer dividends because all of their profits are reinvested to help sustain higher-than-average growth and expansion. Microsoft, for example, did not pay a dividend until it had already become a $350 billion company, long after making the company’s founders and long-term shareholders multi-millionaires or billionaires. Larger, established companies tend to issue regular dividends as they seek to maximize shareholder wealth.

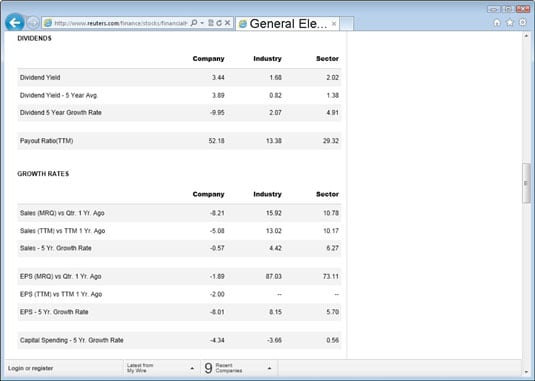

You can calculate a stock’s dividend yield by dividing the annual dividend by the stock’s price. But you can also get it from almost every financial website. Reuters, for example, has an extensive database of dividend information. To get a company’s dividend yield using the Reuters Web site, follow these steps:

-

Go to Reuters’ stocks main page.

-

Enter a ticker symbol in the View Overview For blank.

-

Select the Financials radio button to the right of the red search button, and then click the red search button.

In the new page that appears, scroll down to the dividends section. In the Dividends table, (using General Electric as an example), you can see what a company’s dividend yield is now and what it was on average over the past five years. You can also see what kind of dividend yields other companies in the industry pay.

| Industry | Five-Year Average Dividend Yield, % |

|---|---|

| Real estate investment trusts | 3.0 |

| Multiline utilities (electric power and natural gas) | 3.1 |

| Major drugs | 1.6 |

| Conglomerates | 1.6 |

| Software | 2.0 |

Companies in the following sectors and industries have among the highest historical dividend yields: basic materials, oil and gas, banks and financial, healthcare and pharmaceuticals, utilities, and REITS.

Dividends must be approved by a company’s board of directors each time they are paid. Remember the following important dates:- Declaration date: The day the board of directors announces their intention to pay a dividend. On the declaration date, the Board will also announce a date of record and a payment date.

- Date of record (ex-dividend date): The day when the stockholders are entitled to the dividend payment. A stock will usually begin trading ex-dividend or ex-rights the fourth business day before the payment date. In other words, only the owners of the shares on or before that date will receive the dividend.

- Payment date: The date the dividend will actually be given to the shareholders.

A company might distribute a property dividend to shareholders instead of cash or stock. Property dividends can be any item with tangible value. Property dividends are recorded at market value on the declaration date.

How to calculate the dividend payout ratio

The percentage of net income paid out as a dividend is the dividend payout ratio. This ratio helps project a company's growth. Actually, the retention ratio (the amount not paid out to shareholders in dividends), is used to project growth.Suppose that a company's cash flow statement showed that it paid $2 billion in dividends to shareholders and the income statement showed that it reported a net income of $4 billion. To calculate the dividend payout ratio, do the following:

This company paid out fifty percent of its profit to shareholders during this year.

Dividend reinvestment plans

Some online brokers and companies that sell their shares to investors directly allow you to use dividends paid by a stock to buy more shares of the stock. These programs are called dividend reinvestment plans (DRIPs).The advantages to investing in DRIPs are as follows:

- Enrolling is easy.

- Dividends are automatically reinvested. The process becomes entirely automated and requires no more attention or monitoring.

- Many dividend reinvestment plans are often part of a direct stock purchase plan, and the investor can automatically purchase additional shares of stock through checking or saving accounts.

- Purchases through DRIPs are subject to little or no commission.

- DRIPs allow the purchase of fractional shares.

- An investor can enroll a limited number of shares in the DRIP and receive cash dividends on remaining shares.

Basic Risks of Dividend Investing

Investing in dividend stocks carries some risk — the same as with any other type of stock investment. With dividend stocks, you can lose money in any of the following ways:-

Share prices can drop. This situation is possible regardless of whether the company pays dividends. Worst-case scenario is that the company goes belly up before you have the chance to sell your shares.

-

Companies can trim or slash dividend payments at any time. Companies are not legally required to pay dividends or increase the payments they make. Unlike bonds, where a failure to pay interest can put a company into default, a company can cut or eliminate a dividend whenever it wants. If you’re counting on a stock to pay dividends, you may view a dividend cut or elimination as losing money.

-

Inflation can nibble away at your savings. Not investing your money or investing in something that doesn’t keep pace with inflation causes your investment capital to lose purchase power. With inflation at work, every dollar you scrimped and saved is worth less (but not worthless).

Potential risk is proportional to potential return. Locking your money up in an FDIC-insured bank that pays an interest rate higher than the rate of inflation is safe (at least the first $100,000 that the FDIC insures), but it’s not going to make you rich.

On the other hand, taking a gamble on a high-growth company can earn you handsome returns in a short period of time, but it’s also a high-risk venture.