Distinguishing different trends

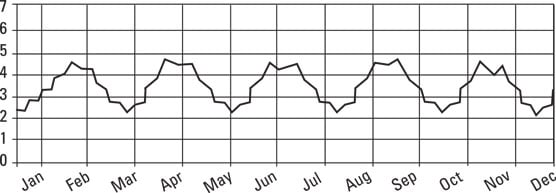

Three basic trends exist:- An uptrend or bullish trend is when each successive high is higher than the previous high and each successive low is higher than the previous low.

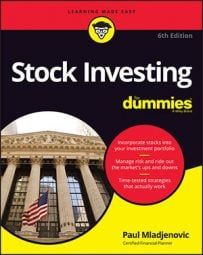

- A downtrend or bearish trend is when each successive high is lower than the previous high and each successive low is lower than the previous low.

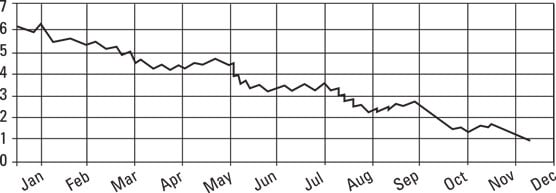

- A sideways trend or horizontal trend shows that the highs and the lows are both in a generally sideways pattern with no clear indication of trending up or down (at least not yet).

Generic chart sloping in a definite downward direction.

Generic chart sloping in a definite downward direction.What do you do with a chart like the one that follows? Yup . . . looks like somebody’s heart monitor while he’s watching a horror movie. A sideways or horizontal trend just shows a consolidation pattern that means that the stock will break out into an uptrend or downtrend.

Generic chart showing a sideways pattern.

Generic chart showing a sideways pattern.Regardless of whether a trend is up, down, or sideways, you’ll notice that it’s rarely (closer to never) in a straight line. The line is usually jagged and bumpy because it’s really a summary of all the buyers and sellers making their trades. Some days the buyers have more impact, and some days it’s the sellers’ turn. This figure shows all three trends.

Chart that simultaneously shows an up, down, and sideways trend.

Chart that simultaneously shows an up, down, and sideways trend.Technical analysts call the highs peaks and the lows troughs. In other words, if the peaks and troughs keep going up, that’s bullish. If the peaks and troughs keep going down, it’s bearish. And if the peaks and troughs are horizontal, you’re probably in California (just kidding).

Looking at a trend’s length

With trends, you’re not just looking at the direction; you’re also looking at the trend’s duration, or the length of time that it goes along. Trend durations can be (you guessed it) short-term, intermediate-term, or long-term:- A short-term (or near-term) trend is generally less than a month.

- An intermediate-term trend is up to a quarter (three months) long.

- A long-term trend can last up to a year. And to muddy the water a bit, the long-term trend may have several trends inside it (don’t worry; the quiz has been canceled).

Using trendlines

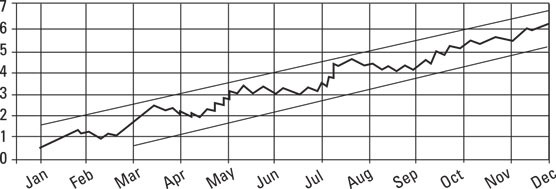

A trendline is a simple feature added to a chart: a straight line designating a clear path for a particular trend. Trendlines simply follow the peaks and troughs to show a distinctive direction. They can also be used to identify a trend reversal, or a change in the opposite direction. The following figure shows two trendlines: the two straight lines that follow the tops and bottoms of the jagged line (which shows the actual price movement of the asset in question). Chart that shows the jagged edge going upward along with the trendlines.

Chart that shows the jagged edge going upward along with the trendlines.Watching the channel for resistance and support

The concepts of resistance and support are critical to technical analysis the way tires are to cars. When the rubber meets the road, you want to know where the price is going:

- Resistance is like the proverbial glass ceiling in the market’s world of price movement. As a price keeps moving up, how high can or will it go? That’s the $64,000 question, and technical analysts watch this closely. Breaking through resistance is considered a positive sign for the price, and the expectation is definitely bullish.

- Support is the lowest point or level that a price is trading at. When the price goes down and hits this level, it’s expected to bounce back, but what happens when it goes below the support level? It’s then considered a bearish sign, and technical analysts watch closely for a potential reversal even though they expect the price to head down.

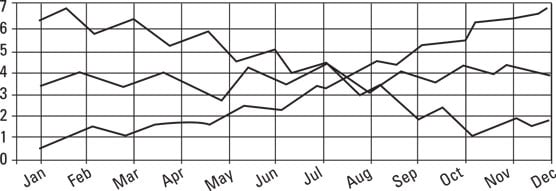

Check out the channel in this figure; it shows you how the price is range-bound. The emphasis on trends is to help you make more profitable decisions because you’re better off trading with the trend than not.

Chart showing a channel.

Chart showing a channel.In the figure, you see a good example of a channel for a particular stock. In this case, the stock is zigzagging downward, and toward the end of the channel, it indicates that the stock is getting more volatile as the stock’s price movement is outside the original channel lines. This tells the trader/investor to be cautious and on the lookout for opportunities or pitfalls (depending on your outlook for the stock).