Be prepared to answer questions for the Series 7 dealing with Long Straddles and Combinations. Straddles are option positions in which the investor buys a call and a put or sells a call and a put on the same underlying security with the same strike price and the same expiration month; if the securities are the same but the strike prices and/or expiration months are different, you have a combination.

What’s nice is that combinations and straddles are virtually the same and the calculations are performed the same way.

Long straddle for Series 7 Exam

A long straddle is buying a call and a put with the same underlying stock, the same strike price, and the same expiration month. Investors who are expecting volatility in the underlying security purchase long straddles.

These investors aren’t sure which direction the stock will go, so they’re covering their bases. They own a call option in case the price of the stock increases, and they own a put option in case the price of the stock decreases. Here’s an example of a long straddle:

Buy 1 DEF Oct 40 call at 6

Buy 1 DEF Oct 40 put at 3

In order to have a long straddle (or combination) you must have two buys.

Long combination for Series 7 Exam

A long combination is buying a call and a put for the same underlying stock with a different strike price and/or expiration month. An investor of a long combination is looking for a security that’s volatile. The investor isn’t sure which direction the security will go, so she buys a call in case the security increases in value and a put in case it decreases in value.

Here’s what a long combination may look like:

Buy 1 LMN Oct 40 call at 6

Buy 1 LMN Oct 30 put at 1

To distinguish a combination from a straddle, look at the expiration months and the strike (exercise) prices. If either one is different or both are different, you’re dealing with a combination.

The following example tests your skill at distinguishing a straddle from a combination.

An investor who owns 1 XYZ Oct 40 call option would like to establish a long combination. Which of the following option positions would fulfill his needs?

(A) Write 1 XYZ Jan 40 put

(B) Buy 1 XZY Oct 30 put

(C) Buy 1 XYZ Oct 40 put

(D) Buy 1 XYZ Jan 30 put

The answer you’re looking for is Choice (D). You can cross off Choice (A) right away because a long combination requires two purchases; Choice (A) is a sell, so it can’t be right. You can cross off Choice (B), too, because although it looks ever so close, it involves a different security. Choice (C) would be correct if the question had indicated that the investor was looking for a straddle.

A long combination, however, is buying a call and a put for the same security with different expiration months and/or different strike prices. Therefore, the only answer that works is Choice (D).

Try another problem to practice:

An investor buys 1 ABC Mar 60 call at 6 and buys 1 ABC Mar 50 put at 3. ABC subsequently increases to 68. The investor exercises the call and immediately sells the stock in the market. After the put expires unexercised, what is the investor’s gain or loss?

(A) $100 gain

(B) $100 loss

(C) $500 gain

(D) $500 loss

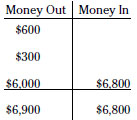

The correct answer is Choice (B). The investor bought the call for $600 (6 × 100 shares per option), so you have to enter $600 in the Money Out section of the options chart because that was money paid from the investor’s pocket.

After that, the investor purchased the put for $300 (3 × 100 shares per option), so you have to enter $300 in the Money Out section of the chart. The next sentence states that the stock increased to 68, but it doesn’t tell you to do anything with that yet, so you don’t.

Next, you have to exercise the call option at the call strike price and place the $6,000 (60 strike price × 100 shares per option) under its premium. This investor sold the stock in the market for $6,800 (68 × 100 shares per option), which is Money In the investor’s pocket. Total up each side, and you see that this investor has a loss of $100.

When you get an option question with several steps (like the preceding one), look for the action words to tell you what to do. Action words include

Buys, holds, owns, longs

Sells, writes, shorts

Exercises

Every time you see an action word, think of it as a clue to remind you that you have to put something in the options chart.