Even if you elect to get quotes from various mortgage providers online, you can also check local mortgage providers. Your local newspaper most likely provides quotes for some of the most competitive mortgage lenders in your community. You may find that working with a local mortgage provider is most convenient. As you see later on in this article, the amount of paperwork that you’re required to pull together and provide to the lender is substantial. When working with a local lender, the loan-acquisition process may be easier than working with an online lender.

Be sure to ask the following questions of potential mortgage lenders:

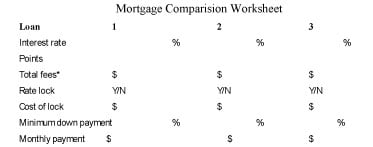

What is the current interest rate of the mortgage being considered?

Are discount points (money you spend to buy down the interest rate) or origination points (fees that some lenders charge) included? Generally, you’ll want a loan with the lowest interest rate without discount points. However, if you have lots of extra cash on hand and plan to stay in the home for a very long time, you may benefit from paying discount points. You should be able to completely avoid origination points.

Will you please provide me with a good-faith estimate illustrating all my fees and closing costs? If the lender refuses, then don’t do business with them!

Can I lock in the interest rate, and if so, what will it cost me to do so? Lenders will allow you to secure an interest rate in advance of closing on your mortgage. You may want to lock in the current rate if you suspect rates will go up before closing. Lenders will charge a fee to provide you with a guaranteed rate. The lower the fee, the better!

What is the minimum down payment required for this loan? Many loans require a 20% down payment. The lender will need to know how much of a down payment you plan on making to determine the right loan options for you.

What is required for me to obtain a prequalification or preapproval letter?

Is there a prepayment penalty on this loan? There's absolutely no reason to obtain a mortgage that has a prepayment penalty. If the lender is offering a loan with a penalty for paying it off early, walk away. The chances of you staying in that home and not refinancing your mortgage at some point over the next 30 years are highly unlikely.

Use the Mortgage Comparison Worksheet when gathering quotes and feedback on the preceding questions from a variety of lenders.

Click here to download and print the Mortgage Comparison Worksheet.

You must remember that the cost of your mortgage includes not only the interest rate, but also the closing costs, which can be substantial. Typically, you should anticipate closing costs to be in the neighborhood of $1,200 to $1,500, but the closing costs do vary greatly between lenders. Generally, these costs must be paid out of pocket, along with any discount points, at closing. However, closing costs and discount points are negotiable items, and you may be able to negotiate with the seller to pay these costs for you. If the seller isn’t paying these costs for you, don’t forget these additional costs must be paid along with your down payment when you close on the mortgage and obtain the deed to your new home.