- Retiring: By the time you hit your 50s and 60s, the size of your monthly mortgage payment, relative to your income and assets, should start to look small or nonexistent. Lowered housing costs can help you afford to retire or cut back from full-time work. Some people choose to sell their homes and buy less-costly ones or to rent out the homes and live on some or all of the cash in retirement. Other homeowners enhance their retirement income by taking out a reverse mortgage to tap the equity that they’ve built up in their properties.

- Pursuing your small-business dreams: Running your own business can be a source of great satisfaction. Financial barriers, however, prevent many people from pulling the plug on a regular job and taking the entrepreneurial plunge. You may be able to borrow against the equity that you’ve built up in your home to get the cash you need to start your own business. Depending on what type of business you have in mind, you may even be able to run your enterprise from your home.

- Financing college/higher education: It may seem like only yesterday that your kids were born, but soon enough they’ll be ready for an expensive four-year undertaking: college. Of course, there are alternatives. Borrowing against the equity in your home is a viable way to help pay for your kids’ higher-education costs.

The decision of if and when to buy a home can be complex. Money matters, but so do personal and emotional issues. Buying a home is a big deal — you’re settling down. Can you really see yourself coming home to this same place day after day, year after year? Of course, you can always move, but doing so, especially within just a few years of purchasing the home, can be costly and cumbersome, and now you’ve got a financial obligation to deal with.

The pros and cons of ownership

Some people — particularly enthusiastic salespeople in the real estate business — believe everybody should own a home. You may hear them say things like “Buy a home for the tax breaks” or “Renting is like throwing your money away.”The bulk of home ownership costs — namely, mortgage interest and property taxes — are tax-deductible, subject to limitations. However, these tax breaks are already largely factored into the higher cost of owning a home. So, don’t buy a home just because of the tax breaks.

If such tax breaks didn’t exist, housing prices would be lower because the effective cost of owning would be so much higher. I wouldn’t be put off by tax reform discussions that mention reducing or even eliminating home-buying tax breaks — the odds of such changes passing are slim to none.Renting isn’t necessarily equal to “throwing your money away.” In fact, renting can have a number of benefits, such as the following:

- In some communities, with a given type of property, renting is less costly than buying. Happy and successful renters I’ve seen include people who pay low rent, perhaps because they’ve made housing sacrifices. If you can sock away 10 percent or more of your earnings while renting, you’re probably well on your way to accomplishing your future financial goals.

- You can save money and hopefully invest in other financial assets. Stocks, bonds, and mutual and exchange-traded funds are quite accessible and useful in retirement. Some long-term homeowners, by contrast, have a substantial portion of their wealth tied up in their homes. (Remember: Accessibility is a double-edged sword because it may tempt you as a cash-rich renter to blow the money in the short term.)

- Renting has potential emotional and psychological rewards. The main reward is the not-so-inconsequential fact that you have more flexibility to pack up and move on. You may have a lease to fulfill, but you may be able to renegotiate it if you need to move on. As a homeowner, you have a major monthly payment to take care of. To some people, this responsibility feels like a financial ball and chain. After all, you have no guarantee that you can sell your home in a timely fashion or at the price you desire if you want to move.

Although renting has its benefits, renting has at least one big drawback: exposure to inflation. As the cost of living increases, your landlord can keep increasing your rent (unless you live in a rent-controlled unit). If you’re a homeowner, however, the big monthly expense of the mortgage payment doesn’t increase, assuming that you buy your home with a fixed-rate mortgage. (Your property taxes, homeowners insurance, and maintenance expenses are exposed to inflation, but these expenses are usually much smaller in comparison to your monthly mortgage payment or rent.)

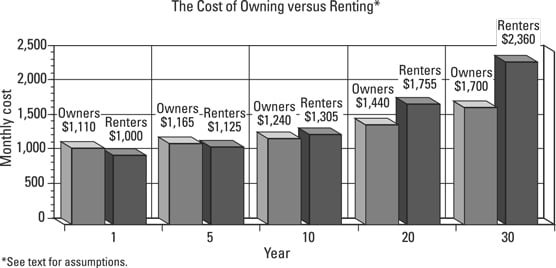

Here’s a quick example to show you how inflation can work against you as a long-term renter. Suppose you’re comparing the costs of owning a home that costs $200,000 to renting a similar property for $1,000 a month. (If you’re in a high-cost urban area and these numbers seem low, please bear with me and focus on the general insights, which you can apply to higher-cost areas.)Buying at $200,000 sounds a lot more expensive than renting for $1,000, doesn’t it? But this isn’t an apples-to-apples comparison. You must compare the monthly cost of owning to the monthly cost of renting. You must also factor the tax benefits of home ownership in to your comparison so you compare the after-tax monthly cost of owning versus renting (mortgage interest on up to $750,000 of mortgage debt and property taxes up to $10,000 worth per year when combined with other state and local taxes are tax-deductible). The figure does just that over 30 years.

Because of inflation, renting is generally more costly in the long run.

Because of inflation, renting is generally more costly in the long run.As you can see in Figure 10-1, although owning costs more in the early years, it should be less expensive in the long run. Renting is costlier in the long term because all your rental expenses increase with inflation. Note: I haven’t factored in the potential change in the value of your home over time. Over long periods of time, home prices tend to appreciate, which makes owning even more attractive.

The example in Figure 10-1 assumes that you make a 20 percent down payment and take out a 4 percent fixed-rate mortgage to purchase the property. It also assumes that the rate of inflation of your homeowners’ insurance, property taxes, maintenance, and rent is 3 percent per year. I’ve assumed that the person is in a moderate federal income tax bracket of 24 percent and about half their mortgage interest and property taxes are effectively reducing their tax burden. In the absence of having enough such deductions to be able to itemize deductions, federal income tax filers now qualify for larger so-called standard deductions.

If inflation is lower, renting doesn’t necessarily become cheaper in the long term. In the absence of inflation, your rent should escalate less, but your home ownership expenses, which are subject to inflation (property taxes, maintenance, and insurance), should increase less, too. And with low inflation, you can probably refinance your mortgage at a lower interest rate, which reduces your monthly mortgage payments. With low or no inflation, owning can still cost less, but the savings versus renting usually aren’t as dramatic as when inflation is greater.

Recouping transaction costs

Financially speaking, I recommend that you wait to buy a home until you can see yourself staying put for a minimum of three years. Ideally, I’d like you to think that you have a good shot of staying in the home for five or more years. Why? Buying and selling a home cost big bucks, and you generally need at least five years of low appreciation to recoup your transaction costs. Some of the expenses you face when buying and selling a home include the following:- Inspection fees: You shouldn’t buy a property without thoroughly checking it out, so you’ll incur inspection expenses. Good inspectors can help you identify problems with the plumbing, heating, and electrical systems. They also check out the foundation, roof, and so on. They can even tell you whether termites are living in the house. Property inspections typically range from a few hundred dollars up to $1,000+ for larger homes.

- Loan costs: The costs of getting a mortgage include items such as the points (upfront interest that can run 1 to 2 percent of the loan amount), application and credit report fees, and appraisal fees.

- Title insurance: When you buy a home, you and your lender need to protect yourselves against the chance — albeit small — that the property seller doesn’t actually legally own the home you’re buying. That’s where title insurance comes in — it protects you financially from unscrupulous sellers. Title insurance costs vary by area; 0.5 percent of the purchase price of the property is about average.

- Moving costs: You can transport all of your furniture, clothing, and other personal belongings yourself, but your time is worth something, and your moving skills may be limited. Besides, do you want to end up in a hospital emergency room after being pinned at the bottom of a staircase by a runaway couch? Moving costs vary wildly, but you can count on spending hundreds to thousands of dollars. (You can get a ballpark idea of moving costs from a number of online calculators.)

- Real estate agents’ commissions: A commission of 5 to 7 percent of the purchase price of most homes is paid to the real estate salespeople and the companies they work for. Higher priced homes generally qualify for lower commission rates.

On top of all these transaction costs of buying and then selling a home, you’ll also face maintenance expenses — for example, fixing leaky pipes and painting. To cover all the transaction and maintenance costs of home ownership, the value of your home needs to appreciate about 15 percent over the years that you own it for you to be as well off financially as if you had continued renting. Fifteen percent! If you need or want to move elsewhere in a few years, counting on that kind of appreciation in those few years is risky. If you happen to buy just before a sharp rise in housing prices, you may get this much appreciation in a short time. But you can’t count on this upswing — you’re more likely to lose money on such a short-term deal.

Some people invest in real estate even when they don’t expect to live in the home for long, and they may consider turning their home into a rental if they move within a few years. Doing so can work well financially in the long haul, but don’t underestimate the responsibilities that come with rental property.