Cloud mining operations are mining farms — data centers dedicated to mining — that sell or lease hashing power to cryptocurrency miners. The essence of the service is that a third-party hosts mining equipment and provides access to the rewards associated with the equipment.

Cloud mining has many advantages and disadvantages. For one, the user must trust the cloud provider in a space ripe with scams and frauds. The user is not in control of the equipment or how it is used.

The advantages, of course, are not having to fill your home with computer equipment, not having to deal with the noise, the heat, the power consumption, and the upkeep of the mining equipment, and so on. Essentially, you outsource the work.

Pool mining versus cloud mining

So what’s the difference between pool mining and cloud mining? In both cases you’re working with a third party:- With pool mining, you need your own mining rig, and through the use of the pool’s software, you contribute your mining rig’s processing power to the mining operation. You’ll need to deal with buying and managing equipment, running the equipment, cooling the equipment, keeping a solid Internet connection up and running, and so on.

- With cloud mining, you are essentially an investor in a mining operation; all you provide is money. Cloud mining companies sign up thousands of individuals to invest various sums into the operation and who take a cut of the proceeds in return. All you need to do is find a reputable cloud-mining operation (be careful!), send them money, and go about your daily business while they manage everything.

Pros and cons of cloud mining

In cloud mining, don’t get to keep blocks you mine (you have to share them); you have to pay the cloud-mining firm a fee to play (but think of all the hassle you avoid!), and like pool mining there is the danger of concentration of power into a small number of hands.You may also find switching more difficult, as some cloud contracts require a longer term commitment; you may not be able to jump ship quickly. Also, on occasion, if mining the particular cryptocurrency becomes unprofitable (as sometimes happens), the operator may cancel the contract.

Carefully do your homework and research on cloud mining firms prior to investing any significant amount of money into these services.

A brief guide to cloud mining

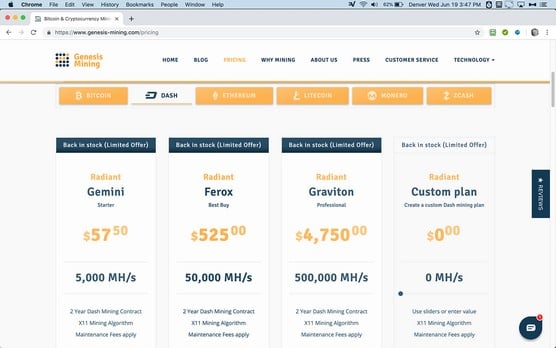

In cloud mining, you essentially fund a portion of a mining operation, and the cloud miners do the rest. You are, in effect, an investor in the operation.These companies offer hash rate contracts. You buy a certain hash rate, for a certain period of time, and you then benefit proportionally based on the percentage of the overall cloud mining operation that you have funded.

Genesis Mining sells hash rate packages. Dash starts at 5,000 MH/s for two years, but you can also mine Bitcoin, Ethereum, Litecoin, Monero, or ZCash.

Genesis Mining sells hash rate packages. Dash starts at 5,000 MH/s for two years, but you can also mine Bitcoin, Ethereum, Litecoin, Monero, or ZCash.

A huge advantage of these services is that it’s totally hands off — no equipment to buy or manage, no space to find for the equipment, no equipment noise, no heat to deal with. Cloud mining service solves those issues for you.

However, cloud mining can also be somewhat risky. Many are not profitable for the durations specified in the contract and can leave purchasers of these services losing money, in some cases, over the long run. Users may have been better off simply purchasing the cryptocurrency that their mining contract mines. (That, of course, is often also true of pool and solo mining.)

Other risks include outright scams. A common mantra in cryptocurrency mining circles is “not your keys, not your coin.” In the case of cloud mining contracts, one might say, “Not your mining hardware, not your rewards.”

The following services rank near the top of trustworthy cloud mining operators. However, caveat emptor, buyer beware. For all services, you must do your due diligence, find out what the community is saying about them, and ensure that they are, or still are, trustworthy and reliable:

This list is brief as many experienced miners only feel comfortable about only a few cryptocurrency cloud mining providers, as many of the rest are not trustworthy and do not offer the services they advertise.However, that doesn’t mean the preceding services always provide profitable mining contracts. It just means they do in fact deliver on the services that they offer and they provide the hash rates advertised for the period promised. But that doesn’t mean profitability at all times.

Cloud mining contracts profitability varies widely between services.

Note also that there’s overlap between pool mining and cloud mining. Some pools will not only use your hash power, but will also sell you hash power. After you’ve set up your account with Honeyminer, for example, the pool will try to sell you more hash power.In effect, you’re connecting your processors to the pool’s node, but you are also providing cash to the pool to purchase more computing power, which they will then manage for you.

Cloud mining is just one option available to cryptocurrency miners. Always do your research before you begin any cryptocurrency mining endeavor.