Even bad situations can mean profits for energy investors. As major oil fields decline in production, investors can profit by investing in crude prices and in oil companies with lower production costs.

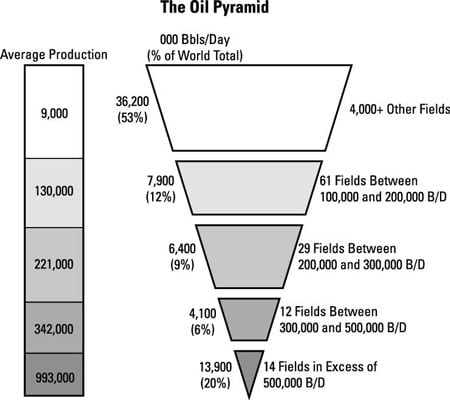

The importance of major oil fields can’t be overstated. Half of all oil produced comes from just 0.03 percent of all oil fields. But many of them are aging and starting to produce less and less oil each year.

Each oil field has a finite amount of oil, and when that oil is extracted, it’s gone forever. As this trend continues, the world is scrambling to find resources to replace these fields. This is one reason so much attention and capital has been spent developing unconventional resources over the past few years.

Because they’re so large, giant oil fields were the first to be discovered. The Ghawar field in Saudi Arabia, for example, was discovered in 1948 and hit peak production in 2005. Mexico’s Cantarell field was discovered in 1976 and now produces just 400,000 barrels per day after peaking at 2.1 million barrels per day in 2004.

Big fields like these may continue to be discovered, but the oil won’t be as easy or cheap to produce because of the type of oil or its location.

The figure illustrates the number and size of the world’s oil fields and what percentage of the world’s oil they produce.

The decline in production from major oil fields means crude oil prices will rise as harder-to-get resources are exploited at higher costs. This is a great scenario for investors who profit from investing in crude prices or for those who invest in oil companies with lower production costs. It also means you’ll have many opportunities outside of the traditional oil powerhouse countries.