Putting everything in order

If you just graduated from school, or you're otherwise in the your early years in the workforce, your increased income and reduction in educational expenses are probably a welcome relief to you and your family — but they're no guarantee of future financial success. Here's how to start on the path to financial success when you first enter the job market:- Avoid consumer credit. The use and abuse of consumer credit can cause long-term financial pain and hardship. Shun making purchases on credit cards that you can't pay for in full when the bill arrives. Here's the simple solution for running up outstanding credit-card balances: Don't carry a credit card. If you need the convenience of making purchases with a piece of plastic, get a debit card.

- Get in the habit of saving and investing. I'm often asked, "At what age should a person start saving?" To me, that's similar to asking at what age you should start brushing your teeth. Well, when you have teeth to brush! You should start saving and investing money from your first paycheck. Try saving 5 percent of every paycheck, and then eventually increase your savings rate to 10 percent. Ideally, you should put your savings into retirement accounts (through an automatic deduction) that offer tax benefits, unless you want to accumulate down-payment money for a home or small-business purchase. (You're probably not thinking about buying a new home or retiring, though, if you're just entering the job market.) If you're having trouble saving money, track your spending and make cutbacks as needed.

- Get insured. When you're young and healthy, imagining yourself feeling otherwise may be difficult. But because accidents and unexpected illnesses can strike at any age, forgoing health insurance coverage can be financially devastating. When you're in your first full-time job with limited benefits, buying disability coverage, which replaces income lost because of a long-term disability, is also wise. And as you begin to build your assets, make a will so your assets go where you want them to in the event of your untimely passing.

Educating and training your way to career success

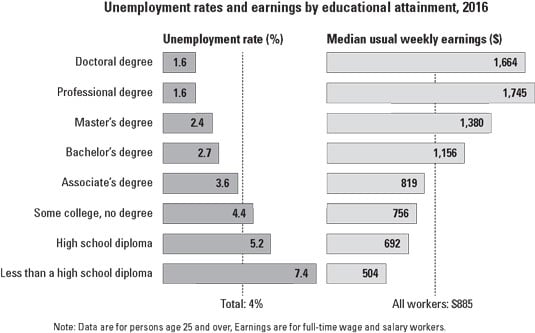

The Bureau of Labor Statistics has data that clearly demonstrates that the more education a person has, the more money the person makes and the less likely the person is to be unemployed (see the most recent full year's data and chart here). Source: U.S. Bureau of Labor Statistics, Current Population Survey

Source: U.S. Bureau of Labor Statistics, Current Population SurveyMore education translates into lower unemployment rates and higher earnings.

Now, you must be careful applying group data to your own situation, because assuming that more education is always better would be inaccurate. But the data clearly shows that more education is generally better, as it enhances your employability and income-earning potential and reduces your chances of being unemployed.

Investing in your career

Plenty of people succeed in their careers. What do they have in common? They invest in their careers, and you can and should do the same. Some time-tested, proven ways to do that include- Networking: Some people wait to network until they've been laid off or are really hungry to change jobs. Take an interest in what others do for a living and you'll benefit and grow from the experience, even if you choose to stay with your current employer or in your chosen field. Online services like LinkedIn enable you to network and see what jobs you may qualify for.

- Making sure you keep growing: Whether it's reading high-quality books or other publications, taking some night courses, or listening to good podcasts, find ways to build on your knowledge base.

- Considering the risk in the status quo: Many folks are resistant to change and get anxious thinking about what could go wrong when taking a new risk.