One of the best ways to manage risk when investing in commodities is to diversify. This strategy applies on a number of levels: both diversification among asset classes, such as bonds, stocks, and commodities; and diversification within an asset class, such as diversifying commodity holdings among energy and metals.

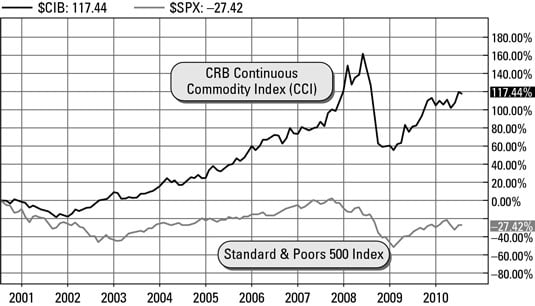

For diversification to have the desired effects on your portfolio (to minimize risk), you want to have asset classes that perform differently. One of the benefits of using commodities to minimize your overall portfolio risk is that commodities tend to behave differently than stocks and bonds.

For example, the performance of commodities and equities is remarkably different. This fact means that when stocks aren’t doing well, you’ll at least have your portfolio exposed to an asset class that is performing.

Early in 2006, the prices of certain commodities, such as crude oil, natural gas, and gold, were in an upward trend line that seemed endless. Of course, every rally eventually comes to an end, either to take a breather before rallying again or to falter and break down completely.

Such was the case with natural gas prices during the summer and early fall of 2006. Natural gas prices, which are notoriously volatile because natural gas is hard to store, broke down after a six-month rally. Several hedge funds were forced to close because of their exposure to natural gas futures.

Hedge funds, and a number of other financial institutions, poured billions of dollars into commodities such as natural gas and copper to profit from — and, naturally, contribute to — the bull market in commodities.

Hedge funds generally have a high tolerance for risk and aren’t afraid to enter into highly leveraged positions (through the use of high margin). Two funds that were exposed to heavy losses were caught against the tide trading natural gas futures contracts in the middle of 2006.

The first fund to suffer massive losses was MotherRock Energy Fund, a half-billion-dollar hedge fund that specializes in energy futures. MotherRock placed huge bets that the price of natural gas was going to drop; it was correct, of course, except that it got the timing wrong — natural gas prices rallied a few more weeks before they dropped.

MotherRock’s unfortunate timing meant that the fund lost $100 million in June 2006 and another $100 million in July 2006. Having lost half its total capital in two months, the fund was forced to shut down.

The second fund that fell victim to wild natural gas price swings was a much larger, multistrategy hedge fund based in Greenwich, Connecticut, called Amaranth Advisors. Amaranth, a fund with approximately $10 billion in assets, invests in various markets, not simply commodities. Its multistrategy focus allows it to enter any market it believes is promising.

The company entered the natural gas market, hoping that its previous successes would allow it to profit in this market as well. Amaranth bet that the prices of natural gas futures would increase; unfortunately for Amaranth (and its investors), natural gas prices decreased, and it was caught on the wrong side of the natural gas tide. As a result, Amaranth lost a whopping $3 billion!

A number of lessons can be gleamed from these hedge fund debacles. First, natural gas futures are extremely volatile. Second, use leverage at your own risk. Third, overconcentration (putting all your eggs in one basket) can be devastating.

These sorts of losses are few and far between, but they remind the investor that investing can be very rewarding but also very dangerous if not done properly. At the end of the day, if you’re going to invest by using margin in volatile commodities, you need to be ready for both spectacular wins and devastating losses.