Installment sales take place whenever purchases are made but not fully paid for at point of sale or delivery. For example, Penway, Inc., wants to totally revamp the office with swanky new furniture and fixtures, but it prefers not to lay out the cash for the purchase all at once upon receipt of the furniture.

Penway finds an office furniture supplier that’s willing to take payments over the next five years. Using the installment method, the office furniture supplier recognizes the revenue for this sale in the periods it receives the payments from Penway instead of at point of sale/delivery.

The theory behind delaying recognition for financial statement purposes is that the risk of not collecting on the installment sale receivable is greater than an accounts receivable. To refresh your memory, accounts receivable reflects all money customers owe to a business for completed sales transactions and due within a shorter time, such as 30 days.

To cover the realizable aspect of revenue recognition, the revenue is booked as it is received; you also book the related gross profit at the same time. Consider the following example:

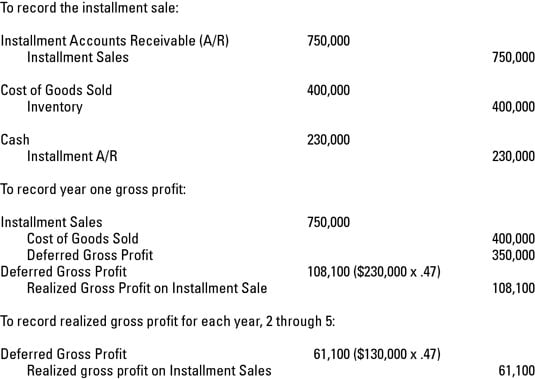

ABC, Inc., sells inventory to XYZ, Inc., for $750,000. XYZ signs an installment sales contract requiring that it pay $100,000 down and $130,000 per year for the next five years, with the first payment also due at signing. Thus, the initial payment is $230,000 ($100,000 + $130,000).

ABC’s cost of inventory sold is $400,000. ABC’s gross profit on the whole shebang is $350,000 ($750,000 – $400,000). ABC also has to figure out the gross profit percentage, which is 46.667 percent (otherwise rounding doesn’t make journal entries work) ($350,000 /$750,000).

All your facts and figures line up, so journalize this transaction!