Temporary differences occur because financial accounting and tax accounting rules are somewhat inconsistent when determining when to record some items of revenue and expense. Because of these inconsistencies, a company may have revenue and expense transactions in book income for 2013 but in taxable income for 2012, or vice versa.

Two types of temporary differences exist. One results in a future taxable amount, such as revenue earned for financial accounting purposes but deferred for tax accounting purposes. This may happen if a company uses the cash method for tax preparation.

The second type of temporary difference is a future deductible amount. The company is reporting an expense on the current tax return but reports it for financial statement purposes in the future. Depreciation is a great example of this.

Now, it’s important to keep in mind that temporary differences smooth out, given enough time. Excess financial income over taxable income in one year eventually reverses as an excess of taxable income over financial income in another year (or vice versa). Because of this, accounting geeks also refer to temporary differences as timing differences.

Quite a few accounting events lead to a temporary difference for book versus tax. Three that commonly occur are accrued liabilities, depreciation, and estimates. Your intermediate accounting book may discuss others. If you understand the concept behind these, you’ll breeze through any others your textbook mentions.

Accrued liabilities. Liabilities are claims against a business, such as contingent liabilities, which is money the company may have to pay out in the future based on events that haven’t yet come to fruition. Under financial accounting, a business has to record liabilities when they’re most probably incurred and the dollar amount can be reasonably estimated.

This rule ensures that the users of the financial statements have relevant information for evaluating the merits of one company against another. Not properly booking accrued liabilities usually understates expenses, which overstates net income. It’s also a pretty big deal when doing ratio analysis.

For tax purposes, liabilities aren’t included until all events establishing and substantiating the liability take place and the liability is reasonably estimated. An example is accruing wages payable to officers of the corporation, which IRC specifically disallows. The company can’t expense those outlandish bonuses until it cuts the checks!

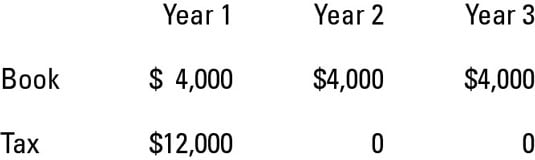

Depreciation. Most accounting books emphasize this example of a temporary difference: For book purposes, the company may use straight-line depreciation, whereas for tax purposes, it may use a more accelerated method, such as IRC Section 179. Under certain circumstances, IRC Section 179 allows a business to write off 100 percent of the cost of the asset in the first year of use.

Financial depreciation methods, on the other hand, call for the asset to be expensed over both the contemporaneous and future years.

To make this concept a little easier to understand, the figure shows the timing difference when using financial versus tax depreciation methods. In this example, the company uses straight-line depreciation for an asset costing $12,000 with no salvage value and a useful life of three years.

As you can see, the same $12,000 ends up on the income statement as a depreciation expense. However, for tax purposes, it all gets expensed in year 1; for book purposes, it’s spread over three years.

Estimates. Estimates are any expenses for which the company figures a reasonable amount, such as warranty costs, which is the cost to repair items sold to customers, or allowance for bad debts, which is how much in accounts receivable the company reckons it won’t collect from customers.

A company can’t deduct estimates as an expense on its tax return until it actually incurs the cost. The IRC has strict criteria for deducting bad debts. For example, a bona fide creditor–debtor relationship must exist, and the debt must be positively uncollectible (for example, the debtor files for bankruptcy and the company is not a secured creditor).

Tax credits are another, more advanced cause behind a difference in book versus taxable income. This is really a subject for a federal taxation class, but for now, know that a business can receive a tax credit, or a dollar-for-dollar reduction in taxes, for many different reasons. For example, a business qualifies for a tax credit if it hires a certain class of disadvantaged employee.