With the last in, first out (LIFO) method, the company assumes that its newest items (the ones most recently purchased) are the first ones sold. LIFO is not codified in GAAP but is a tax concept that Internal Revenue Code (IRC) 472 addresses.

The application of GAAP for LIFO is based on income statement rules — not financial accounting pronouncements. Although GAAP cites LIFO as an acceptable inventory method, it does not give rules for implementing it. So IRC defines financial accounting treatment.

Imagine a big stack of steel rods in a building supply store. If a customer wants to buy a single steel rod, for convenience, he takes one off the top.

As customers purchase the steel rods, new rod purchases are added on top of the old ones instead of redistributing the old rods so they move to the top of the pile. Therefore, the newest rods are consistently sold to customers first.

Many manufacturing companies use LIFO because it more closely matches revenue to expenses than FIFO does. Why? The cost of the item being sold has been incurred closer to the sale in terms of time, so there’s a better match of dollar-to-dollar value.

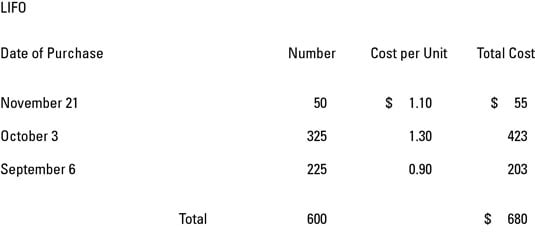

Now you can use the same facts and circumstances from the earlier figure to calculate COGS and value ending inventory using the LIFO cost flow assumption. Using LIFO, you start at the bottom of the list because the company assumes that the last bags of chips it purchased are the first ones sold. The relevant purchases are the chips purchased on November 21, the chips on October 3, and 225 of the chips purchased on September 6. The cost of goods sold is $680, and ending inventory is $853 ($1,533 – $680).

Depending on whether Norfolk Mini-Mart uses FIFO or LIFO, ending inventory for the same facts and circumstances differs by $15 ($695 – $680). Although this difference isn’t dramatic, consider what a difference the accounting method makes if the company has sales in the thousands or millions of units!

LIFO is a big no-no for International Financial Reporting Standards (IFRS).