Aluminum is a lightweight metal that’s resistant to corrosion. Because of these characteristics, it’s a commodity that is widely used to create a number of products, from cars to jets.

Aluminum commodity futures

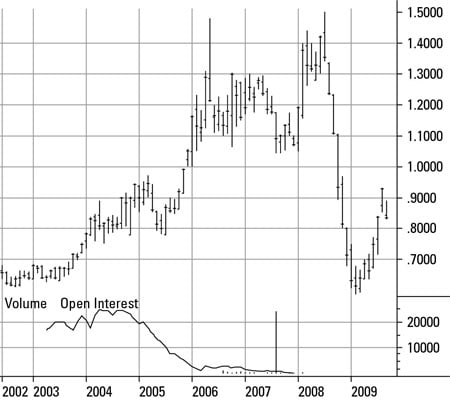

You can invest in aluminum through the futures markets. Previously, two major contracts for aluminum were available. The first one is through the London Metal Exchange (LME); the second one used to trade in the COMEX division of the New York Mercantile Exchange (NYMEX). The COMEX contract was delisted in 2009, after the Chicago Mercantile Exchange (CME) acquired the exchange. As a result, the go-to contract is now the LME.

The London Metal Exchange (LME) aluminum contract is the most liquid in the world. It represents a size of 25,000 tons, and its price is quoted in U.S. dollars.

As you can see, the underlying demand from rapidly industrializing nations such as China and India has resulted in upward price pressures on aluminum.

Aluminum commodity companies

Another way to invest in aluminum is to invest in companies that produce and manufacture aluminum products. A few companies make the cut:

Alcoa (NYSE: AA): Alcoa is the world leader in aluminum production. It’s involved in all aspects of the aluminum industry and produces primary aluminum, fabricated aluminum, and alumina. The company has operations in more than 40 countries and services a large number of industries, from aerospace to construction. If you’re looking to get the broadest exposure to the aluminum market, you can’t go wrong with Alcoa.

Aluminum Corporation of China (NYSE: ACH): As its name implies, ACH is primarily engaged in producing aluminum in the Chinese market. This company, which trades on the New York Stock Exchange (NYSE), is a good investment choice because it gives you a foothold in the aluminum Chinese market, which may potentially be the biggest such market in the future.

Besides this competitive advantage, ACH is a well-run company with profit margins that have been larger than 20 percent at times.