Zinc and nickel are important components of the commodity metals complex because of their wide use in industry. These metals may not get much attention from the financial press, but you still need to consider including them in your portfolio: They’re essential building blocks of the global economy.

Zinc commodities

Zinc is the fourth most widely used metal, right behind iron/steel, aluminum, and copper. Zinc has unique abilities to resist corrosion and oxidation and is used for metal galvanization, the process of applying a metal coating to another metal to prevent rust and corrosion. As you can see, galvanizing metals (particularly steel) is by far the largest application of zinc.

| Sector | Percentage of Market Consumption |

|---|---|

| Galvanization | 47% |

| Brass and bronze coatings | 19% |

| Zinc alloying | 15% |

| Other | 14% |

Source: London Metal Exchange

The best way to invest in zinc is to go through the futures markets. The London Metal Exchange (LME) offers a futures contract for zinc that has been trading since the early 1900s and is the industry benchmark for zinc pricing. The contract trades in lots of 25 tons and is available for trading during the current month and the subsequent 27 months.

![[Credit: Source: U.S. Geological Survey]](https://www.dummies.com/wp-content/uploads/320192.image0.jpg)

Nickel commodities

Nickel is a ferrous metal, which means it belongs to the iron group of metals. It’s an important industrial metal that’s used as an alloy with metals such as iron and copper, and it’s sought after because of its ductility, malleability, and resistance to corrosion.

One of nickel’s primary applications is in creating stainless steel. When steel is alloyed with nickel, its resistance to corrosion increases dramatically. Because stainless steel is a necessity of modern life, and a large portion of nickel goes toward creating this important metal alloy, you can rest assured that demand for nickel will remain strong.

As you can see, although nickel has many important uses, the creation of stainless steel remains its primary application.

| Sector | Percentage of Market Consumption |

|---|---|

| Stainless steel | 65% |

| Nonferrous alloys | 12% |

| Ferrous alloys | 10% |

| Electroplating | 8% |

| Other | 5% |

Australia has the largest reserves of nickel, and its proximity to the rapidly industrializing Asian center — China and India — is a strategic advantage. Another major player in the nickel markets is Russia; the Russian company Norilsk Nickel is the largest producer of nickel in the world. Nickel mining is a labor-intensive industry, but countries that have large reserves of this special metal are poised to do very well.

| Country | Percentage of Total |

|---|---|

| Australia | 37% |

| Russia | 14% |

| Indonesia | 12% |

| New Caledonia | 8% |

| Canada | 5% |

| Cuba | 3% |

| Philippines | 2.5% |

| Papua New Guinea | 2% |

| Brazil | 2% |

| China | 1.5% |

The LME offers a futures contract for nickel. The nickel futures contract on the LME gives you the most direct access to the nickel market. It trades in lots of 6 tons, and its tick size is $5 per ton. As with zinc, it trades during the first month, as well as 27 subsequent months.

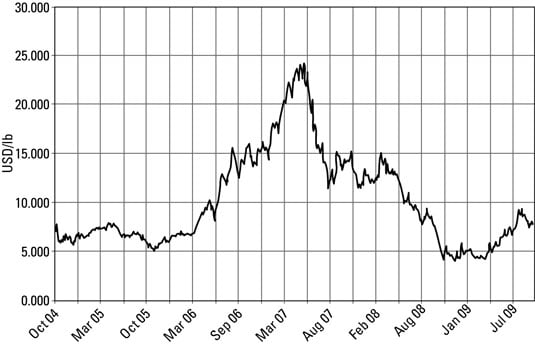

Check out the historical performance of nickel on the LME:

The term nickel, used to denote the 5-cent coin, is misleading because the coin actually consists primarily of copper (75 percent). Nickel, the metal, makes up only 25 percent of nickel, the coin.