Residential use of natural gas accounts for almost a quarter of total consumption of the commodity. A large portion of homes in the United States, as well as other countries, use natural gas for both their cooking and heating needs — the two largest applications of natural gas in the home.

About 70 percent of households in the United States have natural gas ovens in the kitchen. The use of natural gas for cooking purposes has steadily increased as technological developments have allowed for an efficient and safe use of natural gas.

How does this affect you as an investor? As long as folks need to cook, you can bet that natural gas will be there to fill this important need. This essential usage ensures that demand from the residential sector for natural gas will remain strong — a bullish sign for natural gas.

More than 50 percent of homes in the United States use natural gas for heating purposes. One way to benefit from this particular application is to identify peak periods of natural gas consumption. Specifically, demand for natural gas for heating increases in the Northern Hemisphere during the winter seasons.

Therefore, one way to profit in the natural gas markets is to calibrate your strategy to this cyclical, weather-related trend. In other words, all things constant, natural gas prices should go up during the winters as folks seek to stay warm.

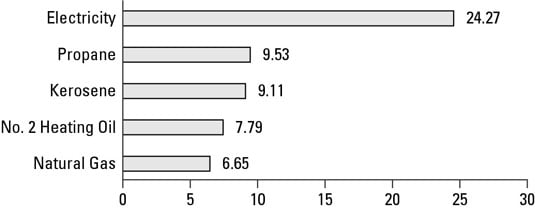

Natural gas is one of the cheapest energy forms, as measured by dollars per unit of energy generated. You get more energy from natural gas per dollar (as measured in British thermal units, the standard energy measurement unit) than from almost any other source. Using natural gas may save you some money during the winters — which you can then use to bulk up your commodities investments!