The future value of an annuity means that you compute the sum of all payments plus the accumulated compound interest on the payments. The amount of an annuity and the interval between receiving and paying the annuity always has to be the same. Then you compound interest once during each interval.

Here, you first find out how to calculate the future value of an ordinary annuity. Then you do the same for an annuity due. Ready to get started? Get out that calculator and proceed.

Future value of an ordinary annuity

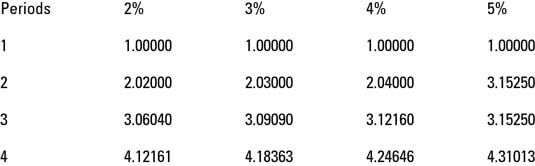

Let’s say that you plan to deposit $1,500 at the end of each six-month period for the next two years, earning 8 percent interest annually. First, this is indeed an annuity because you are depositing the same amount ($1,500) over a constant period of time (every six months). So how much will you have at the end of the two years? To figure this out, you use the future value of an ordinary annuity of 1 table.

In this example, your number of periods is four (remember, you’re depositing the investment every six months, which is two times a year multiplied by two years). Similarly, your interest rate must be halved because the interest rate is in annual, not semiannual, terms (8% / 2 = 4%).

Using the figure, going to the intersection of 4 percent for four periods gives you a factor of 4.24646. At the end of the two years, your money will grow to $6,369.69 ($1,500 @@ts 4.24646). Total cash out of hand for you is $6,000 ($1,500 x 4), and interest income is $369.69 ($6,369.69 – $6,000).

Future value of an annuity due

Using the same principal, time, and rate information from the previous section, it’s time to figure out the future value of an annuity due. Remember, with an annuity due, the payments start at the beginning of the six-month period instead of at the end.

So guess what? The amount of interest you earn on the investment will be higher. You can thank the time value of money, as your investment is accruing interest six months sooner than with an ordinary annuity. Time to work through the numbers.

You still use the future value of an ordinary annuity of 1, but you increase the factor by 1 plus the interest rate. So your factor for an annuity due is 4.41631 (4.24645 x 1.04). $1,500 x 4.41631 is $6,624.47, an increase of $254.78 ($6,624.47 – $6,369.69). Not a lot of money, but consider the implications for businesses that conduct transactions in the millions of dollars.