When you invest in anything, be it exchange traded funds (ETFs), mutual funds, or individual stocks and bonds, there’s always a bit of a gamble involved. (Even when you decide not to invest, by, say, keeping all your money in cash, stuffed under the proverbial mattress, you’re gambling that inflation won’t eat it away or a house fire won’t consume it.) Thus, the best investment advice ever given probably comes from Kenny Rogers:

You got to know when to hold ’em, know when to fold ’em

Know when to walk away and know when to run.

The time to hold ’em is when you have just enough — when you’ve pretty much met, or have come close to meeting, your financial goals.

Meet present Richard and Maria, who are 65 and 58, married, and nearing retirement. Richard, who sank in his chair when asked about his employment, said he was in a job he detests in the ever-changing (and not necessarily changing for the better) newspaper business. Maria was doing part-time public relations work.

Adding up Richard’s Social Security, a small pension from the newspaper, Maria’s part-time income, and income from their investments, Richard didn’t have to stay at a job he hates. There was enough money for him to retire, provided the couple agreed to live somewhat frugally, and provided the investments — $700,000 — could keep up with inflation and not sag too badly in the next bear market.

The couple owned a home, completely paid for, worth approximately $350,000. They both agreed that they could downsize, if necessary.

For a couple like Richard and Maria, portfolio construction is a tricky matter. Go too conservative, and the couple may run out of money before they die. Go too aggressive, and the couple may run out of money tomorrow. It’s a delicate balancing act.

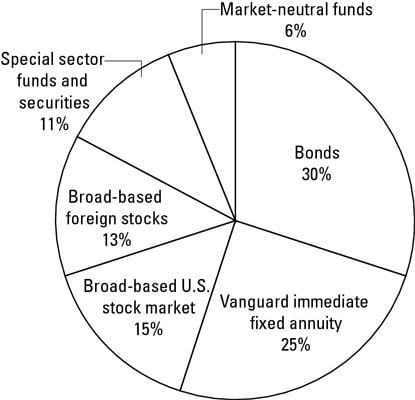

In this case, Richard and Maria’s allocated 25 percent of the $700,000 — $175,500 — to a Vanguard immediate fixed annuity. (The annuity was put in Richard’s name, with 50 percent survivorship benefit for Maria. It was agreed that should Richard die before Maria, she would sell the home, and buy or rent something more economical.)

The rest of the money — $525,000 — was allocated to a broadly diversified portfolio largely constructed using ETFs.

Broad-based U.S. stock market: 15 percent

Vanguard Mega Cap 300 ETF (MGC) 8 percent

Vanguard Small Cap ETF (VB) 7 percent

Broad-based foreign stocks: 13 percent

Vanguard FTSE All-World ex-US ETF (VEU) 7 percent

Vanguard FTSE All-World ex-US Small Cap Index ETF (VSS) 6 percent

Special sector funds and securities: 11 percent

Vanguard International Real Estate ETF (VNQI) 3 percent

SPDR S&P Global Natural Resources ETF (GNR) 3 percent

Plum Creek Timber Company (PCL) 2.5 percent

Rayonier Timber (RYN) 2.5 percent

Bonds: 30 percent

Vanguard Intermediate-Term Corporate Bond Index ETF (VCIT) 15 percent

iShares Barclay TIPS Bond Fund (TIP) 15 percent

Vanguard immediate fixed annuity: 25 percent

With 50 percent survivorship benefit

Market-neutral funds: 6 percent

Hussman Strategic Total Return (HSTRX) 3 percent

Merger Fund (MERFX) 3 percent