The United States tops the list of oil consumers and has been the single largest consumer of the commodity for the last 25 years. Although a lot of folks pay attention to the demand increase from China and India, most of the demand for crude oil (and the resulting price pressures) still comes from the United States.

Traders around the world closely watch supply, but demand figures are equally important because they indicate a steady and sustained increase in crude demand for the mid- to long term. This is likely to maintain increased pressure on crude prices.

| Rank | Country | Daily Consumption (Million Barrels) |

|---|---|---|

| 1 | United States | 19.5 |

| 2 | China | 7.8 |

| 3 | Japan | 4.8 |

| 4 | India | 3.0 |

| 5 | Russia | 2.9 |

| 6 | Germany | 2.6 |

| 7 | Brazil | 2.5 |

| 8 | Saudi Arabia | 2.4 |

| 9 | Canada | 2.3 |

| 10 | South Korea | 2.2 |

Source: United States Department of Energy

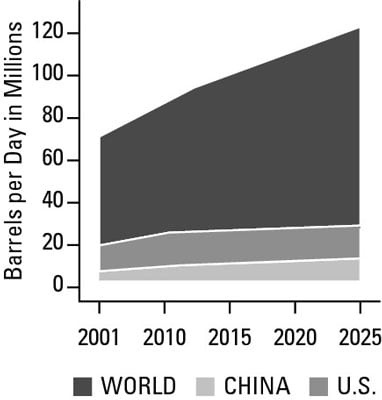

As of 2010, global consumption stood at approximately 86 million barrels per day. The United States and China are currently the biggest consumers of crude oil in the world, and this trend will continue throughout the 21st century, with global consumption expected to increase to 120 million barrels a day by 2025.

An important development to keep track of is that although global consumption figures might remain within a tight trading band, the consumer profile is likely to change. Specifically, you can expect oil consumption in OECD (Organisation for Economic Co-operation and Development) and developed countries to remain stagnant — and, in some cases, experience a decrease — and consumption in emerging market nations to increase.

For example, the trend is for countries like China, India, Russia, and Saudi Arabia to continue to increase domestic consumption as their economies remain in a rapid growth trajectory. Countries that are fairly mature, such as Germany and Canada, won’t experience growth nearly as fast as the emerging market economies.

Below is the expected global consumption through 2025, as well as the expected growth from the two largest consumers, the United States and China.

Always design an investment strategy that will profit from long-term trends. This steady increase in global demand for crude oil is a good reason to be bullish on oil prices.