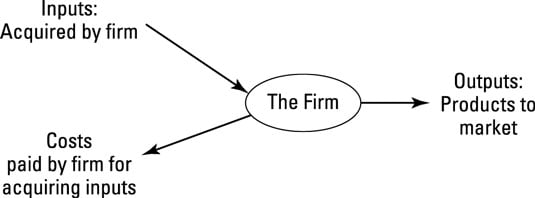

Economists don't take the nature of changing inputs into outputs for granted. Since Adam Smith, economists have been describing in various ways the methods a firm can use to transform inputs into outputs, which they call technologies.

A technology is a description of the way a firm transforms inputs into outputs. Economists aren't restrictive about what makes a technology. Rather than take a narrow definition or restrict the meaning of technology to a particular kind of machine, they take a wider view and say that any method of turning inputs into outputs fits the bill. Whether it involves buying wood and carpentering wood into furniture, or employing people to help clients understand financial planning, it doesn't matter: Those are both descriptions of a technology.

The inputs that go into a technology are called the factors of production. The three most common factors of production are

Land

Labor

Capital

Land: They ain't makin' any more of it

Land is without doubt an important factor of production, but it tends to be studied apart from other inputs. Land costs can be significant and important to the firm, taking up the greater fraction of operating costs for businesses in some places. Land costs can be made worse by restrictions on bringing new land into use or preventing new uses for old land — for instance, in turning former agricultural land into housing.

When economists consider the inputs available to a firm, land is generally held constant and looked at in specific contexts of urban growth rather than considered as part of a technology.

Labor: Getting the job done

The human element of production is labor, usually denoted by L and typically measured in man-hours per week. The firm hires labor by paying wages, w, per man-hour to the workers who are hired to do the work. Thus the total a firm pays out in labor costs is w times L, or wL.

To begin with, economists assume that workers are indistinguishable and undifferentiated so that each worker makes the same contribution to output. This is only where things begin, though, because later, when you've got the hang of the general picture, you can use a variety of more advanced tools to look at various differences between or among workers and how these differences affect output or costs. But for the moment, assume that workers are the same and that each one is neither harder working nor shirking.

Capital: Tangible and intangible

Labor is important, but workers can't create an output on their own without at least some equipment. Carpenters need woodworking tools, and authors need nice flashy laptops, or at least yellow legal pads and pens. Therefore, labor has to be combined with the other factor of production: capital.

There are two types of capital:

Tangible capital: Includes physical capital such as tools, machines, and plant equipment, often measured in machine-hours. A machine is durable and is able to yield a certain number of machine-hours before it breaks down and has to be replaced.

Intangible capital: Includes such assets as brand value and the knowledge and skills embodied in the firm. (Skills embodied in labor are often called human capital.)

In each case, the capital plus labor combine to make the output, and so capital is generally held to be useless on its own. The cost of a unit of capital is denoted by r. This isn't quite the same as the interest rate, because it has to cover the opportunity cost of doing something else with your money rather than buying or investing in capital. If r goes up, then the purchase of capital or investment by firms falls because of the following:

If the firm has to borrow money to increase its use of capital at a higher cost of borrowing, the firm has to borrow more money to invest in the capital it wants.

If the firm is investing its own money, then a higher cost of capital implies that the opportunity cost of investing is higher and that a firm wants higher returns to capital to compare with other opportunities. Therefore, the firm is likely to use less capital.

You can use a number of techniques to evaluate the costs of using and deploying capital, most of which are based on how investors discount the receipt of revenue earned in the future or discounting the value of future earnings and costs so that future and present costs and benefits can be compared.