A business must balance cash register transactions at the end of each day to properly track and record sales transactions. This also helps to ensure that cashiers don’t pocket a business’s cash — cashiers must prove out (show that they have the right amount of cash in the register based on the daily sales transactions) the amount of cash, checks, and charges they took in during the day.

This process of proving out a cash register actually starts at the end of the previous day, when cashier John Doe and his manager agree to the amount of cash left in John’s register drawer. Cash sitting in cash registers or cash drawers is recorded as part of the Cash on Hand account.

When John comes to work the next morning, he starts out with the amount of cash left in the drawer. At the end of the business day, either he or his manager runs a summary of activity on the cash register for the day to produce a report of the total sales taken in by the cashier.

John counts the amount of cash in his register as well as totals the checks, credit-card receipts, and store credit charges. He then completes a cash-out form that looks something like this:

| Receipts | Sales | Total |

|---|---|---|

| Beginning Cash | $100 | |

| Cash Sales | $400 | |

| Credit Card Sales | $800 | |

| Store Credit Sales | $200 | |

| Total Sales | $1,400 | |

| Sales on Credit | $1,000 | |

| Cash Received | $400 | |

| Total Cash in Register | $500 |

A store manager reviews John Doe’s cash register summary (produced by the actual register) and compares it to the cash-out form. If John’s ending cash (the amount of cash remaining in the register) doesn’t match the cash-out form, he and the manager try to pinpoint the mistake. If they can’t find a mistake, they fill out a cash-overage or cash-shortage form. Some businesses charge the cashier directly for any shortages, while others take the position that the cashier’s fired after a certain number of shortages of a certain dollar amount (say, three shortages of more than $10).

The store manager decides how much cash to leave in the cash drawer or register for the next day and deposits the remainder. He does this task for each of his cashiers and then deposits all the cash and checks from the day in a night deposit box at the bank.

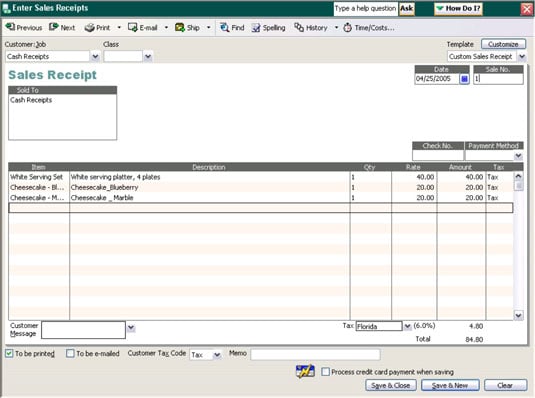

The manager then sends a report with details of the deposit to the bookkeeper so that the data makes it into the accounting system. The bookkeeper enters the data on the Cash Receipts form (see the following figure) if a computerized accounting system is being used or into the Cash Receipts journal if the books are being kept manually.