Your intermediate accounting textbook talks about three situations in which a company may issue a note receivable for other than face value: zero interest bearing, interest bearing, and notes for other than cash. They can be wild and wooly situations!

Zero-interest-bearing notes

These types of notes issue for the present value of the cash the lender gives to the debtor. Keep in mind that the future value of $1 is assumed to be worth more than the present value of $1.

With that caveat in mind, let’s say Joseph Inc. lends Michael Company $20,000, with payment due in five years. Joseph figures that the present value of the $20,000 is $13,612. The difference between $20,000 and $13,612 of $6,388 is the discount on notes receivable.

How did Joseph get the present value of $13,612? You don’t have to compute this for your intermediate accounting classwork on notes receivable. However, for inquiring minds, Joseph has an effective interest rate of 8 percent. Going to the present value of 1 table, the factor at the intersection of 8 percent and five periods is .6806. $20,000 x .6806 is $13,612.

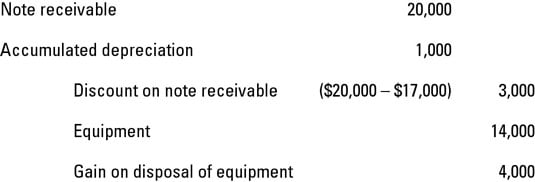

The discount on notes receivable account is a contra-asset account. It follows the note receivable, amortized over the five-year life. It moves from the balance sheet to the income statement via interest revenue using the effective-interest method. The following figure gives you a bird’s-eye view on how this works, assuming that the effective interest rate is 8%.

Cash doesn’t factor into this schedule because Joseph receives no cash until the end of the fifth year.

Journalize the first year by debiting discounts on notes receivable for $1,089 and crediting interest revenue for the same amount. For the second year, you debit discounts on notes receivable and credit interest revenue for $1,176; in year three, you use $1,270, and so on for the remaining two years.

Interest-bearing notes

The concept from the prior section is somewhat the same for interest-bearing notes, except that the market and stated interest rates quite often are different. Time to walk through an example.

Going back to the $20,000 and effective interest rate of 8 percent example from the “Zero-interest-bearing notes” section earlier, the note receivable has a stated interest rate of 6 percent. At the stated rate, interest is $1,200 per year ($20,000 x .06). Michael pays interest to Joseph at the end of each year.

You know the present value of the principal is $13,612. However, you also need to figure out the present value of the interest portion of the note. Use the present value of an annuity of 1 table for the interest because it’s a series of payments.

The factor at the intersection of 8 percent and five years in the present value of an annuity of 1 table is 3.9927. The present value of the interest is $4,791 ($1,200 x 3.9927). Add the two present value figures to get the carrying value of the note, which is $18,403 ($13,612 + $4,791). Subtract $18,403 from the face value of the note receivable to get the discount of $1,597 ($20,000 – $18,403).

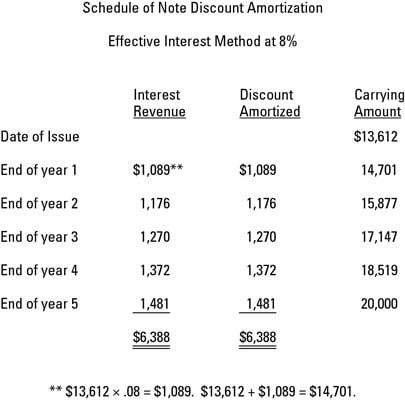

The following figure shows the schedule for this transaction with a 6 percent note discounted at 8 percent.

Bringing it home with the journal entry to record payment at the end of each year, journalize the first year by debiting cash for $1,200, discounts on notes receivable for $272, and crediting interest revenue for $1,472. For the second year, you debit cash for $1,200 discounts on notes receivable for $294 and credit interest revenue for $1,494, and so on for the remaining three years.

Notes received for property, goods, or services

Sometimes companies exchange notes for value other than cash. In that case, use the stated interest rate unless one of the three circumstances exists:

There’s no stated interest rate.

The stated interest rate is unreasonable. For example, it’s not in line with what’s fair for the marketplace.

The face amount of the note differs materially from the cash price of the property, good, or service.

If one of these three rears its ugly head, use the fair market value of the property, good, or service subject to the note transaction to approximate the present value of the note receivable.

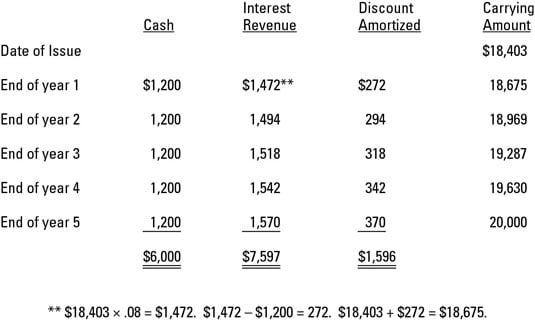

Going back to the Joseph (lender) and Michael (debtor) transaction, imagine that Joseph sells equipment to Michael for $20,000 on a note with no stated interest rate. The equipment has a fair market value of $17,000 and a basis of $13,000 (cost of $14,000 and accumulated depreciation of $1,000) on Joseph’s books. The following figure shows how to journalize this transaction.