It’s a sad fact of life that businesses extending credit to their customers will probably have at least one or more deadbeat customer who just won’t pay the bills. Under generally accepted accounting principles (GAAP), you have to make a valuation adjustment for uncollectible accounts.

GAAP requires that businesses extending credit to customers use the allowance method, which means they estimate uncollectible accounts. Companies use a few different types of methods, usually based on their past experience with bad debt.

For example, imagine that a company that’s been in business for five years has found that 2 percent of all credit sales will be uncollectible. Nothing in the current period causes the company to question the correctness of this percentage for the contemporaneous financial period, so it again uses this method and percentage. Here’s an example of how this works:

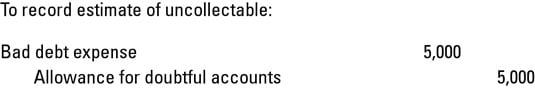

Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x .02). The journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Here are the journal entries:

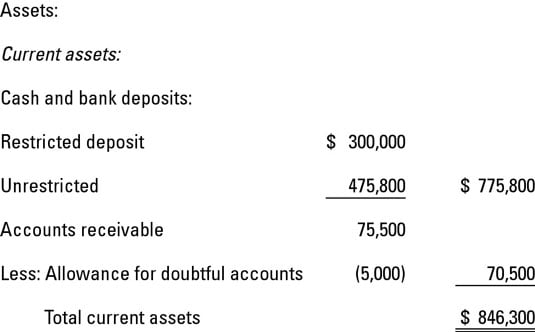

Following is the balance sheet presentation.

This figure assumes gross accounts receivable is $75,500.

When you determine that a particular customer’s account is uncollectible (maybe the customer died and left no estate or closed up shop), your next step is to remove the balance from both allowance for uncollectible accounts and the customer accounts receivable balance. After all, this is no longer a mystery — you know that the customer won’t be coughing up the cash.

For example, Parmelee Supplies owes you $1,000. You send a past-due notice that the post office returns as undeliverable, with no forwarding address. After following up, you have no success at locating Parmelee. The journal entry is to debit allowance for uncollectible accounts for $1,000 and credit A/R – Parmelee Supplies for $1,000.