Each state sets its own unemployment tax rate. Many states also charge additional fees for administrative costs and job-training programs. The percentage an employer must pay isn’t a set amount but instead is a percentage range. The employee income amount upon which this percentage is charged also varies from state to state. The percentage range is based on the company’s employment history and how frequently its employees collect unemployment.

After you know what your rate is, calculating the actual FUTA tax you owe isn’t difficult.

As an example, consider a new company that’s just getting started in the state of Florida; it has ten employees, and each employee makes more than $8,000 per year. For state FUTA taxes, use the new employer rate of 2.7 percent on the first $8,000 of income. The federal FUTA is the same for all employers — 6.0 percent. Here’s how you calculate the FUTA tax for this company:State unemployment taxes:

$8,000 x 0.027 = $216 per employee

$216 x 10 employees = $2,160

Federal unemployment taxes:

$7,000 x 0.060 = $420

$420 x 10 employees = $4,200

The company doesn’t have to pay the full federal amount because it can take up to a 5.4 percent credit for state taxes paid ($7,000 x 0.054 = $378). Since state taxes in Florida are 2.7 percent of $8,000, this employer can’t subtract the full amount of Florida FUTA taxes from the federal FUTA tax. It can only subtract 2.7 percent of the first 7,000 or $189 per employee for a total of $1,890: $4,200 – $1,890 = $2,310.

So this company only needs to pay $2,310 to the federal government in FUTA taxes. Any company paying more than $378 per employee to the state is only able to reduce its federal bill by the maximum of $378 per employee. So, every employer pays at least $56 per employee into the Federal FUTA pool.

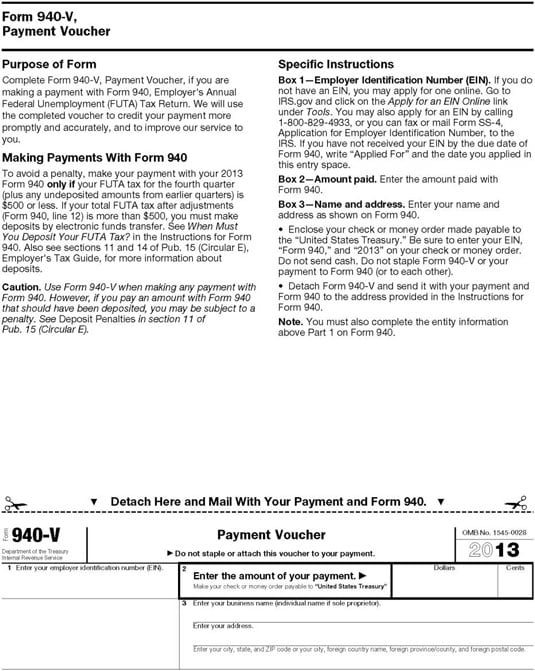

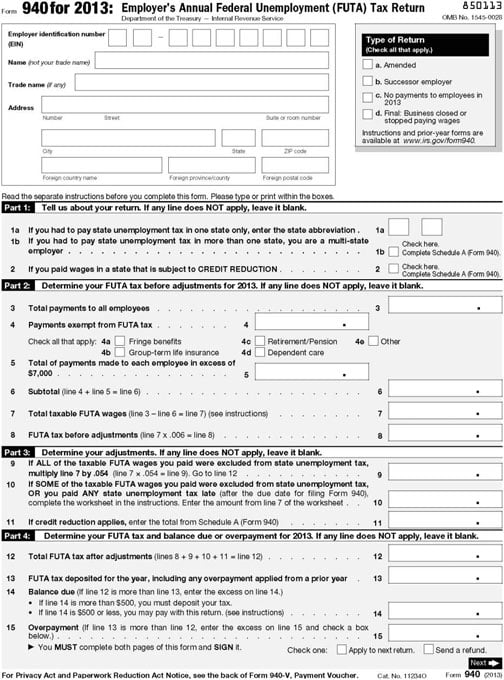

Each year, you must file IRS Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return. The first page of Form 940 is shown here, and the second page is shown next.

You can pay taxes for Form 940 electronically using EFTPS. Most employers pay unemployment taxes quarterly, but if the amount you must pay is less than $100 in any one quarter, you can wait until at least $100 is due. For example, if you owe $50 in federal unemployment taxes in one quarter, you can wait two quarters before making the payment.