If you plan to sell inventory, you need some inventory to sell. That’s why you need a production budget. The production budget computes the number of units the company needs to produce in order to meet its sales budget. To prepare a production budget, you estimate how much inventory the company wants to keep in stock at the end of each period.

To prepare a production budget, start with the formula for inventory flow:

Beginning + Inputs – Ending = Outputs

In master budgeting, you know the outputs (how many units you need) — just check out the sales budget. And you can find beginning and ending units on the company’s estimates of inventory needed at the end of each period.

Therefore, the missing number you’re after in the production budget is inputs. How many units do you need to make? Rearrange the formula like so:

Inputs = Outputs + Ending – Beginning

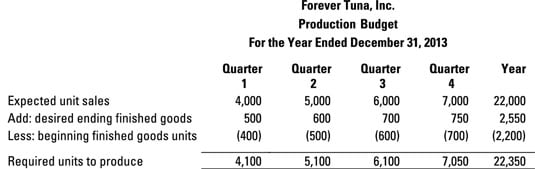

Plug the numbers in for Forever Tuna’s first quarter. According to the sales budget, the company plans to sell 4,000 units in the first quarter and 5,000 units in the second quarter. Managers keep inventory equal to 10 percent of the following period’s sales. The company starts its first quarter in 2013 with 400 units.

At the end of the first quarter, it needs 500 units (that is, 5,000 units projected to be sold in the second quarter times 10 percent).

Inputs = Outputs + Ending – Beginning

Inputs = 4,000 + 500 – 400

Inputs = 4,100 units

The company needs to produce 4,100 units.

A full-blown production budget computes this information for a whole year. Forever Tuna projects unit sales of 4,000 in Quarter 1 of 2013. The production budget is shown here.

The number of beginning units in one period always equals the number of ending units in the prior period. Similarly, the cost of beginning inventory always equals the cost of ending inventory in the last period.