Technology gives you a hand here: No accounting software package worth its salt will let you enter a lopsided transaction into the accounting books.

© pandapaw / Shutterstock.com

© pandapaw / Shutterstock.comThe fundamental accounting equation

The fundamental accounting equation (also known as the accounting equation or the balance sheet equation) proves that all transactions are equal and opposite. It demands thatAssets = Liabilities + Owners’ equityA truncated version of this equation states

Net assets = Owners’ equityThis version of the equation just moves liabilities over to the other side of the equal sign; net assets are all assets minus all liabilities. Before we go any further, I need to define our cast of characters in this equation:

- Assets are resources a company owns. Some examples are cash, equipment, and cars.

- Liabilities are debts the company owes to others. The biggie liabilities you encounter in your financial accounting class or at work as a financial accountant are accounts payable and notes payable.

- Owners’ equity is what’s left over in the business at the end of the day — a company’s assets minus its debts. Many financial accounting textbooks define owners’ equity as the owners’ claim to the company’s assets.

You may read the explanation of owners’ equity and think, “That’s just another way to say ‘net worth’.” But you can’t use the term net worth interchangeably with owners’ equity in an accounting setting. Generally accepted accounting principles (GAAP) do not allow accountants to restate assets to their actual value, which would be required to calculate a company’s net worth.

Here’s a simple example of the fundamental accounting equation at work; assume the numbers represent a company’s assets, liabilities, and owners’ equity in thousands, millions, or perhaps even billions of dollars:Assets = Liabilities + Owners’ equityOr100 = 40 + 60

Net assets = Owners’ equity60 = 60

Get familiar with accounts

As an accountant within a business, you summarize accounting transactions into accounts that you use to create financial reports. Each and every account your company uses is annotated in a list called the chart of accounts. The business uses that chart of accounts to record transactions in its general ledger: the record of all financial transactions within the company during a particular accounting cycle.The chart of accounts is not a financial report. It is merely a list of all accounts you’ve previously set up to handle the company transactions.

When you’re “doing the books,” as the saying goes, you record your normal business transactions using accounts you set up in the chart of accounts. Each account in the chart of accounts has a unique account number. Regardless of what accounting software package your company uses, the numbering sequence is pretty much set in stone to ensure consistency among companies and among their financial reports.The number of accounts you can set up in the chart of accounts is virtually unlimited, so you can customize it to fit your business perfectly. Here’s the numbering sequence that’s most used for charts of accounts:

| Number Sequence | Account Type |

| 1000 to1999 | Assets |

| 2000 to 2999 | Liabilities |

| 3000 to 3999 | Equity |

| 4000 to 4999 | Income |

| 5000 to 5999 | Cost of goods sold expenses |

| 6000 to 7999 | Operating, general, and administrative expenses |

| 8000 to 9999 | Non-business-related items of income and expense |

Instead of using a four-digit numbering sequence, some software programs use a three-digit numbering sequence. For example, instead of 1000 to 1999 for assets, some software programs may use 100 to 199.

Here’s a brief explanation of the accounts in the 5000–9999 numbering sequence:- Cost of goods sold (COGS) expenses: COGS is the cost of the product that a company sells. The company can either make the product that it sells or buy it from someone else and then resell it.

- Operating, general, and administrative expenses: These accounts reflect all expenses a business incurs while performing its business purpose that do not directly relate to making or wholesaling a product — in other words, any expense that’s not a COGS. Some examples are telephone and postage expenses.

- Nonbusiness-related items of income and expense: A company may bring money in or spend money that generally accepted accounting principles (GAAP) classify as nonbusiness-related. For example, a business treats interest it earns on investments as nonbusiness income. If a company sells an asset at a loss, that’s an example of a nonbusiness expense.

Keep in mind that if a company is in the business of loaning money, interest earned on these loans is considered business income. Likewise, a car dealership must report losses on sales of vehicles as business expenses.

Defining debits and credits

Now that you understand the basics of accounts and the chart of accounts, it’s time to learn the mechanism of journal entries, which you use to enter financial information into the company’s accounting software.Writing journal entries is a major area of concern for first-year accounting students, students who are taking accounting only because it’s required for a business degree, and small business owners. The logistics of presenting the journal entry don’t cause the concern; instead, the worry is how to figure out which account is debited and which is credited.

Here’s one of the immutable laws of accounting: Assets and expenses are always debited to add to them and credited to subtract from them. Liability, revenue, and equity accounts are just the opposite: These accounts are always credited to add to them and debited to subtract from them. Always, always, always — there is no exception to this rule.

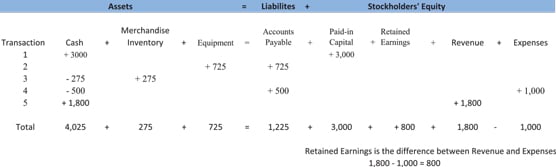

Many financial accounting textbooks attempt to ease the student into debits and credits through horizontal analysis, which uses statement-driven information to record transactions using the terms adding and subtracting instead of debits and credits. I find this approach more confusing to my students because it erroneously reinforces the untruth that debiting means “adding to” and crediting means “subtracting from” — which is not always true.Because you will have homework and test questions using horizontal analysis, it’s important I give you the information you need for you to be a superstar when answering these questions. First, I’ll set up the facts of the business transactions leading to the horizontal analysis.

Say that you opened an Etsy shop to market your handcrafted tables. You run an ecofriendly shop using reclaimed wood that you salvage from abandoned buildings, fences, and other structures. April 2021 is the first month you are in business, for which you have the following five transactions:

- You open a business bank account with a contribution to your business of $3,000.

- You purchase $725 of woodworking equipment.

- A salvage trip resulted in a fantastic score of pine planks, which the owner of the property sold to you for $275 cash.

- An independent programmer charges you $1,000 to set up your Etsy shop. You gave the programmer a deposit of $500 and agreed to pay the balance next month.

- While you were unloading the pine planks, a passerby paid you $1,800 cash for a finished coffee table in your garage.

Horizontal analysis

Horizontal analysisLearning about the transaction methodology

Before you enter an event into a business accounting system, you have to consider the transaction methodology, a five-step process for deciding the correctness of whatever entry you’re preparing. After you get into the financial accounting rhythm, this becomes an automatic analysis you do by rote. Here are your five considerations:- What’s going on? This question addresses the precipitating event for the entry. For example, did the company buy a new piece of business equipment or sell some product to a customer?

- Which accounts does this event affect? Is the account an asset, liability, owners’ equity, revenue, or expense? Assets would definitely be affected by the purchase of business equipment, and revenue would be affected by a customer sale.

- How are the accounts affected — by a debit or credit? Looking back to your rules of debits and credits, buying assets adds to the account so it’s a debit. Making a sale adds to a revenue account so it’s a credit.

- Do all debits for an entry equal all credits for the same entry? Think about the fundamental accounting equation. For every debit there has to be an equal credit.

- Does the entry make sense? Do the actions you take match the facts and circumstances of the business event? For example, although the net effect on the books is the same, you can’t credit an expense to record revenue.