After you complete your accounting work for the accounting cycle in which your business operates, it’s time to reexamine your General Ledger. Some accounts in the General Ledger need to be zeroed out so that they start the new accounting cycle with no detail from the previous cycle, while other accounts continue to accumulate detail from one cycle to the next.

When you break down the General Ledger, the balance sheet accounts carry forward into the next accounting cycle, and the income statement accounts start with a zero balance.

Zeroing out income statement accounts

When you’ve made all needed corrections and adjustments to your income statement accounts, you can zero out all General Ledger accounts listed on the income statement: revenues, Cost of Goods Sold, and expense accounts. Because the income statement reflects the activities of an accounting period, these accounts always start with a zero balance at the beginning of an accounting cycle.

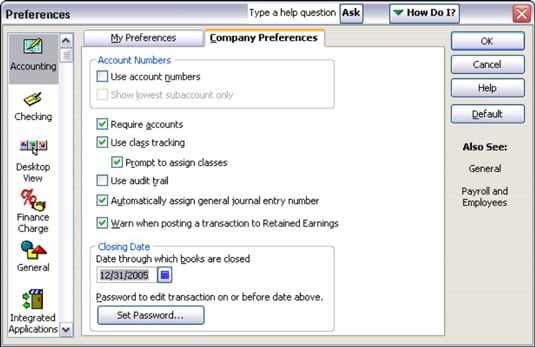

If you use a computerized accounting system, you may not actually have to zero out the income statement accounts. For example, QuickBooks adjusts your income and expense accounts at cycle-end to zero them out so you start with a zero net income, but it maintains the data in an archive so you’re always able to access it. You can set your closing date on the Company Preferences tab of the Preferences box, as shown:

To control who can make changes to prior year accounts, you should also click Set Password to set a special password for editing closed accounts.

Carrying over balance sheet accounts

Unlike income statement accounts, you never zero out the accounts listed on a balance sheet (assets, liabilities, and equity). Instead, you note your ending balances for each of these accounts so you can prepare a balance sheet, and you carry forward the data in the accounts into the next accounting period.

The balance sheet gives you a snapshot of the financial state of your company as of a particular date in time. From one accounting cycle to the next, your assets and liabilities remain, and you also need to maintain the information about how much equity your investors have put into the company.