After you complete all your tax forms for individual employees, contractors, and vendors, you’re left with two annual summary reports that must be filed with the federal government:

Form 940, Employer’s Annual Federal Unemployment Tax Return contains an annual summary of your federal unemployment tax payments. You file this form quarterly as well as annually.

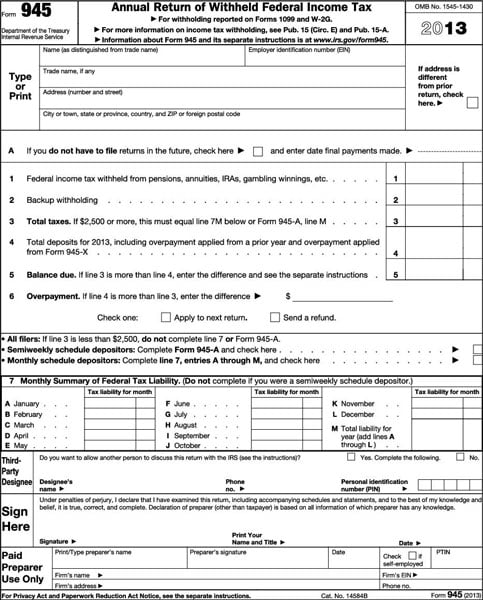

Form 945, Annual Return of Withheld Income Tax is a summary of all federal income tax withheld from vendors, contractors, pensions, or annuities. In most cases, this form just serves as a summary of the payments you make throughout the year as you withhold taxes. You can see a sample of Form 945 here: