When you were an employee, you probably noticed that every company you ever worked for waited until the last possible day to provide you with your W-2s. Now that you’re preparing these documents for your employees, you have a better understanding of your employers’ delay — it takes time to put W-2s together. Preparing these forms can be a very time-consuming task, especially if you want to make sure they’re correct.

If you use a computerized accounting system’s payroll software package to prepare your W-2s, there’s no doubt that the task is much easier, but it still takes time to run the reports and review them to be sure everything is accurate before printing the final forms.

Although you can send out corrected W-2s if necessary, filing the additional forms is just a lot of extra work, so you want to avoid correcting a W-2 whenever possible. The best way to eliminate the need for corrections is to be very careful in checking all information on the forms before distributing them to your employees.

Your company may be required to pay penalties if your W-2 forms are prepared incorrectly or aren’t filed on time with your employees or with the government. The three levels of penalties for incorrectly filed W-2s or W-2s not prepared on time are as follows:

$30 for each W-2 that you file late or need to correct, provided that late filing is done within 30 days of the due date.

The maximum penalty at this level for a company is $250,000. Small companies with average annual gross revenues under $5 million face only a $75,000 penalty maximum.

$60 for each W-2 that you file late or need to correct more than 30 days after the due date and before August 1.

The maximum penalty at this level for large companies is $500,000, and smaller companies face a $200,000 maximum penalty.

$100 for each W-2 that you file after August 1 or fail to prepare altogether.

The maximum penalties at this level are $1,500,000 for large companies and $500,000 for small businesses.

You can avoid these penalties if you can prove to the federal government that your failure to file W-2s on time was the result of an event beyond your control, such as a fire that destroyed all your records, and not the product of neglect.

You must also indicate the steps you took to avoid filing late. You can also avoid penalties if incorrect information on a W-2 wasn’t significant or didn’t hinder the work of the IRS or the Social Security Administration in processing the W-2 information.

You can also be hit with a suit for civil damages if you fraudulently file a W-2 claiming you paid someone wages you didn’t actually pay. The person may sue you for any damages incurred because of this fraudulent W-2.

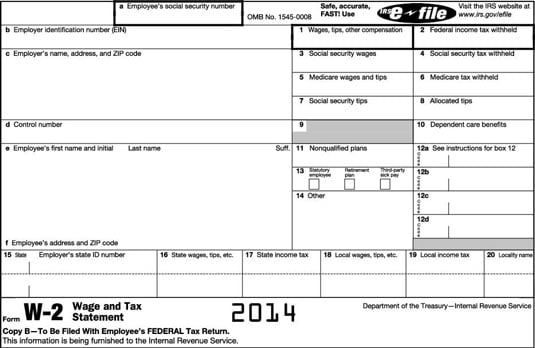

Most of the information required to put together an employee’s W-2 should be kept as part of your payroll records and therefore be easy to pull together. When filling out the W-2, which you can see in the figure, you must supply information for the following boxes:

Box 1: Wages, tips, other compensation. The total in this box should also include the value of any employee bonuses, prizes, awards, or noncash payments that aren’t exempt or excluded from taxes.

Box 2: Federal income tax withheld.

Box 3: Social Security wages. Some benefits are exempt from wages for the purposes of federal income tax but aren’t exempt from Social Security.

Box 4: Social Security tax withheld.

Box 5: Medicare wages and tips. This amount is likely to be the same as the amount in Box 3, Social Security wages.

Box 6: Medicare tax withheld.

Box 7: Social Security tips. Any tips your employees reported to you should be reported here.

Box 8: Allocated tips. Some businesses choose to allocate tips rather than collect and report tips for each employee separately. If you do that, report the tips in this box rather than in Box 7.

Box 9: Advance EIC payment. If you paid employees advances on their Earned Income Credit, record the value of those advances in this box.

Box 10: Dependent care benefits. If you provide dependent care benefits to an employee, report the provided amount in this box.

Box 11: Nonqualified plans. In this box, you report any distribution to your employees of assets from nonqualified retirement plans, which are retirement plans that don’t meet the requirements of the federal government. (Qualified plans such as 401(k)s, IRAs, pensions, and others are reported on 1099-R.)

Box 12: The box contains numbers coded between A to Z. Each letter is for reporting a different type of income. For example, Code A is for uncollected Social Security tax on tips, and Code J is for nontaxable sick pay. You can get a complete list of these codes in the IRS publication Instructions for Forms W-2 and W-3, available by mail or online.

Box 13: This box contains three boxes that you check according to what applies to the employee in question:

Check the first box, labeled Statutory employee, if the employee can report income and expenses as a business, such as an agent or traveling salesperson.

Check the second box, labeled Retirement plan, if you provide a qualified retirement plan for your employees.

Check the third box, labeled Third-party sick pay, if you provide payment for an employee as a third-party for sick pay. This box is usually used if a third-party is paying an employee’s workers’ compensation.

Box 14: Other. This is the place for information you want to share with the employee, such as details about fringe benefits that were included in the total for Box 1.

Boxes 15–20: In these boxes, you report payroll details for state and local tax information.

You must furnish your employees with W-2s by January 31. Usually, you give employees four copies of the form:

One for the employee’s file

One to be filed with federal tax forms

One to be filed with state tax forms

One to be filed with local tax forms (which aren’t always necessary)

You also need to make one copy for your company files and one copy to send along with Form W-3.

W-2s for the previous year must be delivered to employees by January 31. However, if you’re mailing W-2s to employees, they can be mailed on or before January 31. If January 31 falls on a weekend, you can mail the forms on the first business day after January 31. If for some reason you can’t meet the January 31 deadline, you must file for an extension with the IRS by sending a letter to:

Internal Revenue Service

Information Returns Branch

Attn: Extension of Time Coordinator

240 Murall Drive, Mail Stop 4360

Kearneysville, WV 25430

Your letter must include

Your business name and address

Your employer identification number

A statement indicating that you’re requesting an extension to furnish W-2 forms to employees

The reason for the delay

Your signature or the signature of your authorized agent

If you don’t get an extension and can’t show reasonable cause, you’ll be penalized $30 to $100 (depending how late you are) per W-2 (up to $1,500,000 for large companies and $500,000 for small businesses).

The penalty from the IRS can be even stiffer if it determines that your failure to provide W-2 forms on time was an “intentional disregard of payee statement requirements” (that’s straight from the IRS’s mouth). If your failure’s judged as intentional, the fine is $100 per W-2 with no maximum penalty.