When a company asks their accountant to determine the cost of producing goods they have sold, the results will depend on their choice of inventory valuation method. The following practice questions use the LIFO method and the average cost method.

Practice questions

Use the following information to answer the next two questions:

Placebo Clip-On Tie Company had one tie in inventory at the beginning of the year, and it cost $5. On February 10, the company bought another tie for inventory, and it cost $8. On March 10, the company bought another tie for $10; on April 3, it purchased another for $12; and on May 12, it bought another for $15. In June, Placebo sold three ties.

If the company uses the LIFO method of recording cost of goods sold expense, how much is cost of goods sold?

If the company uses the average cost method of recording cost of goods sold expense, how much is cost of goods sold?

Answers and explanations

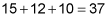

$37

The LIFO method assigns the costs of the most recently acquired inventory to cost of goods sold. That would be the cost of the units acquired on May 12, April 3, and March 10.

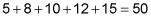

$30

The average cost method calculates the cost of all units available for sale during the period.

Then, a cost per unit is calculated using the cost of all units available for sale divided by the total number of units available for sale.

Then, that cost per unit is multiplied by the number of units sold to arrive at cost of goods sold expense — 10 ×3 = 30.

If you need more practice on this and other topics from your accounting course, visit Dummies.com to purchase Accounting For Dummies! Featuring the latest information on accounting methods and standards, the information in Accounting For Dummies is valuable for anyone studying or working in the fields of accounting or finance.