The amount reported in a business’s balance sheet for owners’ equity is called its book value. The book value per share is the measure of the recorded value of the company’s assets less its liabilities — the net assets backing up the business’s stock shares.

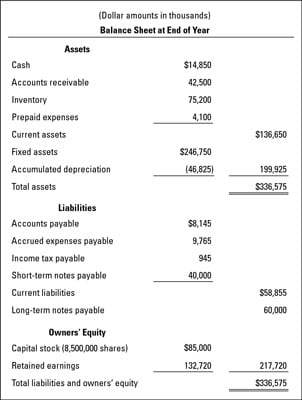

In the example shown in the figure below, the book value of owners’ equity is $217.72 million at the end of the year. This amount is the sum of the accounts that are kept for owners’ equity, which fall into two basic types:

Capital accounts (for money invested by owners minus money returned to them)

Retained earnings (profit earned and not distributed to the owners)

Just like accounts for assets and liabilities, the entries in owners’ equity accounts are for the actual, historical transactions of the business.

Book value is not market value. The book value of owners’ equity is not directly tied to the market value of a business. You could say that there is a disconnect between book value and market value, although this goes a little too far. Book value may be considered heavily in putting a market value on a business and its ownership shares. Or, it may play only a minor role.

Other factors come into play in setting the market value of a business and its ownership shares. Market value may be quite a bit more than book value, or considerably less than book value. Whether or not it is known, market value is not reported in the balance sheet of a business.

Public companies have one advantage: You can easily determine the current market value of their ownership shares and the market cap for the business as a whole (equal to the number of shares × the market value per share.) The market values of capital stock shares of public companies are easy to find. Stock market prices are reported every trading day in many newspapers and on the Internet.

Private companies have one disadvantage: There is no active trading in their ownership shares to provide market value information. The shareowners of a private business probably have some idea of the price per share that they would be willing to sell their shares for, but until an actual buyer for their shares or for the business as a whole comes down the pike, market value is not known.

Even so, in some situations there is a need to put a market value on the business and/or its ownership shares. When a shareholder dies or gets a divorce there is need for a current market value estimate of the owner’s shares (for estate tax or divorce settlement purposes). When making an offer to buy a private business, the buyer puts a value on the business.

One value of the ownership shares for both public and private businesses is book value per share. You calculate the book value per share for a business as follows:

Owners’ equity ÷ Number of stock shares outstanding = Book value per share

The business shown in the figure has issued 8.5 million capital stock shares. The book value of its $217.72 million owners’ equity divided by the number of stock shares gives a book value per share of $25.61.

If the business sold off its assets exactly for their book values and paid all its liabilities, it would end up with $217.72 million left for the stockholders, and it could therefore distribute $25.61 per share to them. But, of course, the company doesn’t plan to go out of business, liquidate its assets, and pay off its liabilities anytime soon.

Is book value the major determinant of market value? No, generally speaking book value is not the dominant factor that drives the market price of a stock — not for a public company whose stock shares are traded every day, nor for a private business when a value is being put on the business. EPS is much more important for public companies.

Book value per share is important for value investors, who pay as much attention to the balance sheet factors of a business as to its income statement factors. They search out companies with stock market prices that are not too much higher, or even lower, than book value per share.