Investors and lenders calculate the acid-test ratio — also known as the quick ratio or the pounce ratio — to test a business’s short-term solvency. The acid-test ratio is a more severe test of a business’s solvency (its capability to pay the liabilities that will come due in the short term) than the current ratio.

The acid-test ratio excludes inventory and prepaid expenses, which the current ratio includes, and it limits assets to cash and items that the business can quickly convert to cash. This limited category of assets is known as quick or liquid assets.

You calculate the acid-test ratio as follows:

Liquid assets ÷ Current liabilities = Acid-test ratio

Like the current ratio, you don’t multiply the result of this equation by 100 and represent it as a percentage.

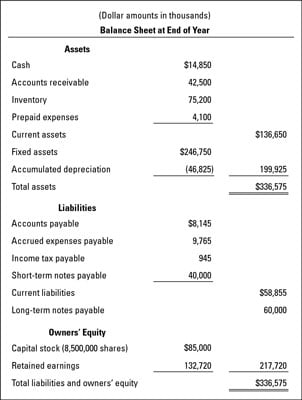

The business example in the figure below has two “quick” assets: $14.85 million cash and $42.5 million accounts receivable, for a total of $57.35 million. (If it had any short-term marketable securities, this asset would be included in its total quick assets.)

Total quick assets are divided by current liabilities to determine the company’s acid-test ratio:

$57,350,000 quick assets ÷ $58,855,000 current liabilities = .97 acid-test ratio

Its .97 to 1.00 acid-test ratio means that the business would be just about able to pay off its short-term liabilities from its cash on hand plus collection of its accounts receivable. The general rule is that the acid-test ratio should be at least 1.0, which means that liquid (quick) assets should equal current liabilities. If the ratio falls as low as 0.5, that may be cause for alarm.

This ratio is also known as the pounce ratio to emphasize that you’re calculating for a worst-case scenario, where a pack of wolves (known as creditors) could pounce on the business and demand quick payment of the business’s liabilities. However, short-term creditors do not have the right to demand immediate payment, except under unusual circumstances. This ratio is a conservative way to look at a business’s capability to pay its short-term liabilities — too conservative in most cases.