After a business’s product is sold, the product cost is taken out of inventory and recorded in the cost of goods sold expense account. One main accounting decision that must be made by companies that sell products is which method to use for recording the cost of goods sold expense, which is the sum of the costs of the products sold to customers during the period.

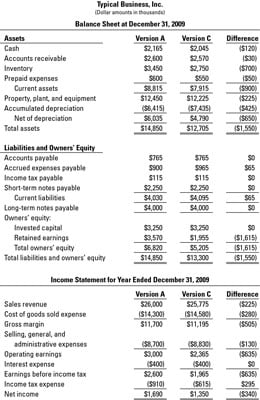

You deduct cost of goods sold from sales revenue to determine gross margin — the first profit line on the income statement (see the following figure). Cost of goods sold is a very important figure, because if gross margin is wrong, bottom-line profit (net income) is wrong.

A business acquires products either by buying them (retailers and distributors) or by producing them (manufacturers). For retailers, product cost is simply purchase cost. Product cost is entered in the inventory asset account and is held there until the products are sold.

When a product is sold, but not before, the product cost is deducted from inventory and is then added to the cost of goods sold expense account. Suppose that you clear $700 from your salary for the week and deposit this amount in your checking account. The money stays in your bank account and is an asset until you spend it. You don’t have an expense until you write a check.

Likewise, not until the business sells products does it have a cost of goods sold expense. When you write a check, you know how much it’s for — you have no doubt about the amount of the expense. But when a business withdraws products from its inventory and records cost of goods sold expense, the expense amount is in doubt — it depends on which accounting method the business selects.

A business can choose between two opposite methods to record its cost of goods sold and the cost balance that remains in its inventory asset account:

The first-in, first-out (FIFO) cost sequence

The last-in, first-out (LIFO) cost sequence

Other methods are acceptable, but these two are the primary options.

Product costs are entered in the inventory asset account in the order acquired, but they are not necessarily taken out of the inventory asset account in this order. The different methods refer to the order in which product costs are taken out of the inventory asset account. You may think that only one method is appropriate — that the sequence in should be the sequence out. However, generally accepted accounting principles (GAAP) permit alternative methods.

The choice between the FIFO and LIFO accounting methods does not depend on the actual physical flow of products. Generally speaking, products are delivered to customers in the order the business bought or manufactured the products — one reason being that a business does not want to keep products in inventory too long because the products might deteriorate or show their age.

So, products generally move in and move out of inventory in a first-in, first-out sequence. Nevertheless, a business may choose the last-in, first-out accounting method.