Understanding how joblessness can hit younger adults harder

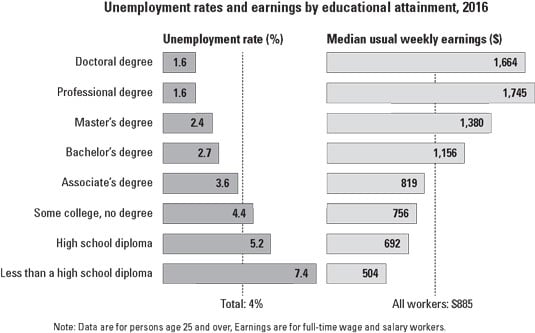

During the severe recession from 2007–2009, high unemployment rates were all over the news as the unemployment rate surpassed 10 percent in the United States. But that double-digit level of joblessness paled in comparison to the high level of unemployment for young people, especially those who were less well educated.Despite the multi-year expansion that the U.S. economy has enjoyed since 2009, the youngest adults (those under 25) have continued to have higher levels of unemployment than the rest of the working adult population. Adults without a high-school diploma have an unemployment rate far greater than the average, followed by high-school graduates who have no college experience. College graduates have by far the lowest unemployment rate. (The following figure helps you understand the rate of unemployment and average weekly earnings based on education level.)

Source: U.S. Bureau of Labor Statistics, Current Population Survey

Source: U.S. Bureau of Labor Statistics, Current Population SurveyMore education translates into lower unemployment rates and higher earnings.

The typical out-of-work person tends to be young and not well educated. Although you can't do anything about your age, you can do something about your education.

Accessing unemployment benefits

If you're laid off and unemployed, you should collect unemployment benefits if you're eligible. You must be actively seeking employment and meet any other eligibility requirements in your state.The simplest way to find the state unemployment insurance office nearest you is to visit this website and click Unemployment Benefits on the home page. CareerOneStop operates this site — a U.S. Department of Labor–sponsored website that provides "career resources and workforce information to job seekers, students, businesses, and workforce professionals to foster talent development in a global economy."

Unemployment benefits are provided at the state level, and each state has its own program. If you're turned down for benefits, be sure to clarify why, and don't be shy about appealing the decision if you feel there's a chance you may get approved if you're able to furnish more information.Taking action to stay on top of your finances when unemployed

You can make the most of your finances and be best prepared to handle life's challenges if you stay on top of your financial affairs. That said, losing one's job often comes as a surprise and presents some unusual stresses. Here are some tips to keep in mind if you lose your job:- Batten down the hatches. Evaluating and slashing your current level of spending may be necessary. Everything should be fair game, from how much you spend on housing to how often you eat out to where you do your grocery shopping. Avoid at all costs the temptation to maintain your level of spending by accumulating consumer debt.

- Work at your job search a few hours daily but not on a full-time basis. Searching for a job is hard work and creates stress for most people. You're probably not going to make the most of your job search by making it your full-time endeavor. Make some calls; arrange some appointments; send some résumés; and do some research on industries, companies, and organizations of interest every day. But I suggest doing so for no more than four to six hours per day. If you can find part-time or temporary work, spend some time doing that to earn some money and to break up the monotony of looking for work.

- Try to exercise regularly. Exercise clears the head and lifts your mood. Daily exercise is best, but if that's not possible, try to get some exercise at least every other day.

- Eat healthfully. As with exercise, eating a balanced and nutritious diet can go a long way toward maximizing your mental (and physical) health and outlook.