Here’s an overview of how citizens perceive their tax dollars being spent, what the annual tax tally adds up to, and where tax dollars really go.

Americans’ estimates of U.S. federal spending

Many Americans believe that some relatively minor federal programs receive much more in federal spending than they actually do, as the following examples illustrate:-

Foreign aid: Americans estimate foreign aid at 10 percent of the federal budget, and a fifth think it represents about 30 percent of the money the government spends. Actual spending on foreign aid is less than one percent.

-

Funding for the Corporation for Public Broadcasting: The public estimates that the government spends about 5 percent on public television and radio, when the actual amount is approximately one-tenth of one percent.

-

Pensions and benefits for government workers: On average, Americans think the federal government spends about 10 percent; 3.5 percent is a more accurate estimate.

-

Food and housing assistance for the poor: Americans' spending estimates are three to four times higher than the actual costs of these programs.

How much tax money does the federal government take in?

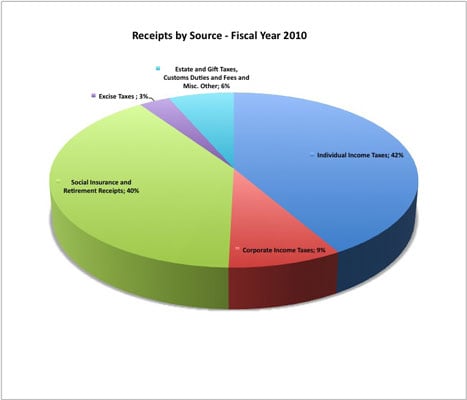

Total federal revenues were $2.16 trillion in fiscal year 2010 from individual income taxes, social insurance and retirement receipts, corporate income taxes, excise taxes, estate and gift taxes, customs duties, Federal Reserve deposits, and some miscellaneous receipts.

Source – Budget of the United States Government: Historical Tables Fiscal Year 2012

Where does the federal government spend tax money?

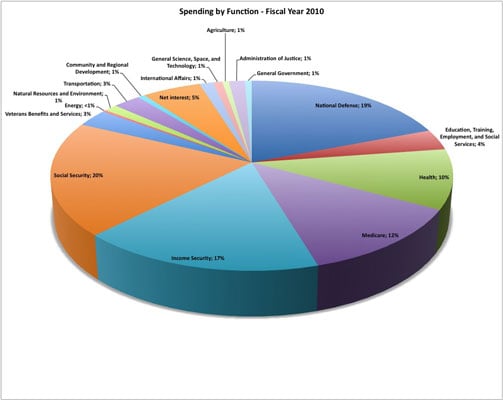

Spending by the Federal government is divided into two categories: mandatory and discretionary.Mandatory spending includes programs — mostly entitlement programs — that are funded by eligibility rules or payment rules, authorized by permanent laws. In this case, Congress creates a program and then determines who is eligible for the program, how much each eligible participant will receive, and any other criteria. Spending is then determined by estimates of the number of eligible participants. Congress may change the eligibility and participant funding levels at any time.

Mandatory spending makes up about two-thirds of the total federal budget and includes programs such as Social Security (the largest), Medicare, veterans’ benefits, food stamps, along with interest on the national debt. This chart shows all government spending, both mandatory and discretionary, for fiscal year 2010.

Source – Budget of the United States Government: Historical Tables Fiscal Year 2012

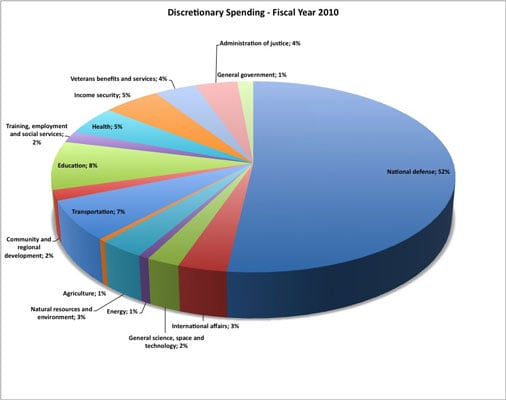

Discretionary spending refers to the portion of the budget that Congress approves through the annual appropriations process. In this case, Congress directly sets spending levels of individual discretionary programs, meaning that they may increase or decrease spending on any of those programs in a given year.

Discretionary programs include activities such as defense, education, the FBI and the Coast Guard, housing, foreign aid, space exploration, highway construction, border patrol, agriculture, immigration, and emergency disaster relief, among others. The discretionary budget is about one-third of total federal spending.

The following chart illustrates the breakdown of discretionary spending for fiscal year 2010.

Source – Budget of the United States Government: Historical Tables Fiscal Year 2012

The White House tax receipt and WhereDidMyTaxDollarsGo provide additional perspective on the federal budget.