At the end of the surrender period, the contract expires. You have to buy a new contract or roll over to it.

Be sure you understand your actual rate; an agent or broker may throw a lot of different terms at you, including all or most of the following:

-

The base rate: The interest rate the company pays you the first year

-

The bonus rate: The bonus the company adds to the interest rate in the first year

-

The current rate: The base rate plus the bonus rate

-

The current yield: The interest rate your money will earn over the entire term of the contract if the company does not lower its base rate

-

The guaranteed yield: The lowest possible interest rate you can earn

-

Renewal rates: The rates after the first year

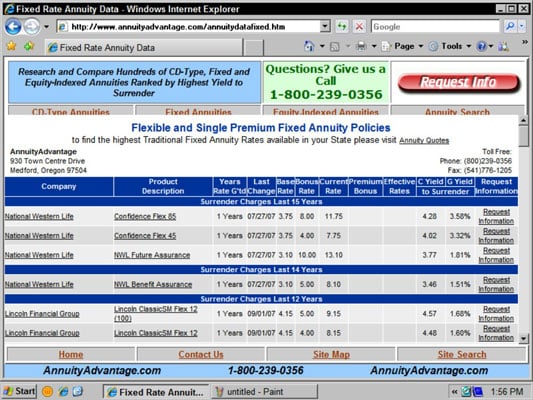

A table of renewal rates can tell you whether the company has a history of raising, lowering, or maintaining the base interest rates of its single-year guarantee contracts after the first year.

Ask your agent or broker for a renewal rate table, or look up the contract’s interest rate history online. The following figure shows a sample rate table from the Annuity Advantage Web site. (Rate histories are routinely provided to annuity salesmen, but not necessarily to customers.)

A table of fixed annuity rates from the Annuity Advantage Web site.

A table of fixed annuity rates from the Annuity Advantage Web site.