-

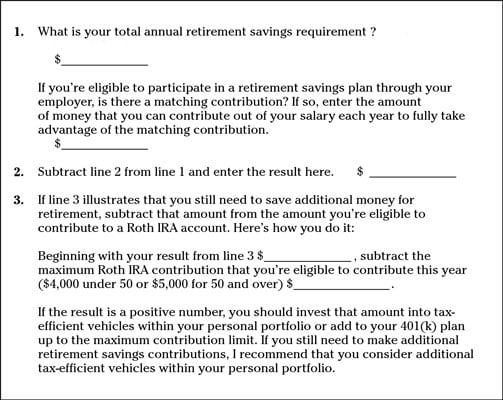

Use of your 401(k) or 403(b) plans. If you have a 401(k) or 403(b) plan through your employer and your employer provides a matching contribution, fund this account up to the limits of the matching contribution. For example, if your employer matches 50 cents on every dollar that you contribute to your 401(k), up to 6 percent of your annual salary, you should contribute 6% of your salary to your 401(k).

By participating in your qualified retirement plan at work and receiving a matching contribution from your employer, you’re receiving a guaranteed rate of return of no less than 50 percent per year.

-

Check into a Roth IRA. The Roth IRA is one of the most underappreciated and underused retirement vehicles available today. Everyone who qualifies to make a Roth IRA contribution and still needs to save for retirement should do so by utilizing a Roth.

To qualify to make a Roth IRA contribution, individual taxpayers must have an adjusted gross income of less than $99,000 per year, or $156,000 per year for taxpayers filing jointly.

You receive no tax deduction by contributing to a Roth IRA account; however, all earnings accumulate on a tax-deferred basis, and all withdrawals taken out during retirement are tax-free. You never have to pay tax on the earnings in this account.

There are limits to how much you can contribute to a Roth IRA each year, depending on your age. But regardless of your age, you should be able to fulfill your retirement savings requirement by contributing up to the matching amount in your 401(k) plan and making up the balance of your required contribution into a Roth IRA account.

-

Option A: If you haven’t yet built up a personal portfolio in your own name, invest in low-cost, tax-efficient vehicles such as no-load index mutual funds or exchange-traded funds.

-

Option B: If you already have accumulated a fairly reasonable personal portfolio and feel comfortable that you have enough accessible funds in the case of an emergency, I suggest that you continue to fund your 401(k) or 403(b) plan beyond the matching contribution to fulfill the amount needed to fully fund your retirement savings.

Use the Retirement Savings Implementation strategy Worksheet to help you allocate your annual required retirement savings contributions among the best retirement investment vehicles available to you today.

Click here to download and print the Retirement Savings Implementation Strategy Worksheet.