When you analyze the market, you can choose to be a trend-follower or a swing-trader. In technical analysis, the trend is always the focus. In a perfect world, you first determine whether your security is trending or range-trading sideways, and then you apply the appropriate indicator.

In practice, you can’t always classify price moves as trending or not trending in a neat and tidy way. Besides, prices usually have an identifiable range, whether they’re trending or not. In addition, retracements always create doubt — is it a momentary correction or a reversal?

Here are the types of analysis styles:

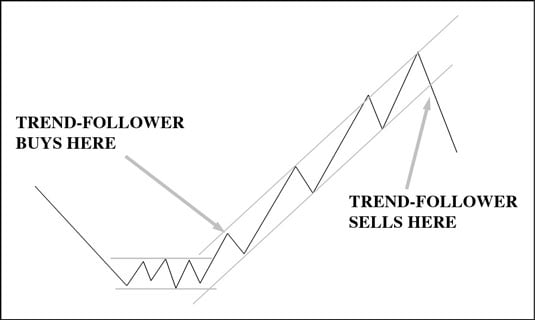

Trend-followers: Traders who like to identify trends may wait out retracements and sideways range-trading situations until they resolve back into a trend. Other trend-followers use information from momentum indicators to modify their position, for instance by taking some profit when the security becomes overbought/oversold even though the trend is just pausing and they expect it to continue.

The following figure illustrates a trend, complete with minor retracements, and shows how a trend-following trader makes decisions.

If you choose trend-following, you’re choosing to suffer through the downward bounce in an uptrend (or the upward bounce in a downtrend). You’re going to wait it out, and if you have correctly identified the trend, your patience pays off and the trend resumes.

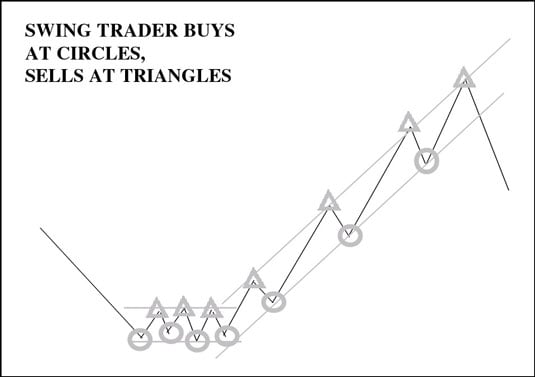

Swing-traders: Swing-traders buy at relative lows and sell at relative highs, regardless of whether the price is trending. A swing-trader may know that a price is downtrending, for example, but he’s still willing to buy it for a short-term profit opportunity when a momentum indicator says it’s temporarily oversold and likely to enjoy a bounce upward.

The following figure shows how the swing-trader tries to capture every move, including the retracements.