The global warming movement has changed the energy sector of the commodities market, increasing reliance on renewable energy sources over fossil fuel sources. Scientifically speaking, global warming is the increase in the earth’s temperature in surface and near-surface air and oceans due to increased greenhouse gas emissions from man-made activities such as the burning of fossil fuels.

According to the Intergovernmental Panel on Climate Change (IPCC), a United Nations intergovernmental body, global warming is a scientific fact that can be proven using empirical scientific methods. In 2007, the IPCC received the Nobel Peace Prize for its work on global warming; Al Gore was a co-recipient.

This group has come under fire by many in the energy and fossil fuel industry who challenge the assumptions behind the scientific approach used to reach these conclusions. According to this camp, increased temperatures have been part of the earth since prehistoric times and have little to do with man-made activities.

These two camps are bitterly divided, which has decreased the likelihood of reaching a compromise on the scientific approach. You’re entitled to your own opinions on the validity of these claims and counterclaims, but it’s indisputable that the renewable energy industry is here to stay — and presents some terrific investment opportunities.

In practical terms, renewable energy refers to sources of energy that are essentially always present, always available, and always renewable. The sun and wind are traditional sources of renewable energy because the sun always shines and the wind always blows, day in and day out.

Harnessing these renewable sources of energy is beneficial for a couple reasons. First, they’re always there. Second, they don’t emit any greenhouse gases, which decreases pollution output.

The benefits of renewable energy are obvious, but one of the big obstacles to implementing a large-scale, global industry is less obvious: cost.

For instance, the cost of harnessing the power of the sun to generate electricity is extremely high and requires massive commitments of capital expenditures. The solar industry currently needs heavy government subsidies to be able to generate enough profits to remain competitive; the same applies to wind energy and other types of renewable energy, such as ethanol.

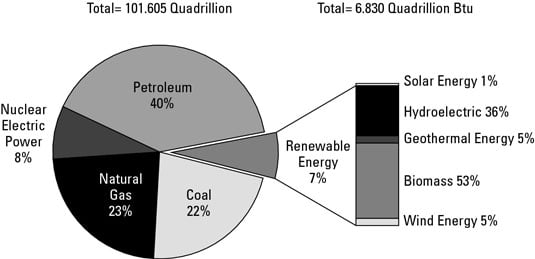

Renewable energy as a whole represents only a small fraction of the total energy landscape in the United States, which is also attributable to the broader global footprint. Getting exposure to some of these sectors from an individual portfolio perspective is difficult. For example, unless you own or operate geothermal plants, you have few direct methods for getting this kind of exposure.

Here is the breakdown of energy sources in the U.S. in 2009:

Although it’s currently more challenging to get direct exposure to different renewable energy submarkets (such as geothermal), this will undoubtedly change in the future as more instruments are made available and as the market gains more breadth and credibility.

In addition, you can adopt a creative approach to getting this kind of exposure; for example, if you want to get exposure to hydroelectric power generation, you can examine the electric utilities universe for companies that have hydroelectric power assets. This strategy may not give you that direct investment route, but you can still manage to generate indirect exposure in your portfolio.

If you’re interested in keeping up-to-date on the latest developments in the renewable energy space, check out the Department of Energy’s Energy Efficiency and Renewable Energy (EERE) initiative. For the United Nations’ official intergovernmental policy view on global warming and greenhouse gases, consult the Intergovernmental Panel on Climate Change (IPCC).