The commodity that’s currently the biggest component of the renewable energy industry is biomass, accounting for 53 percent of total production estimates. Scientifically speaking, biomass energy is produced by processing common wastes and transforming them into renewable energy through a biochemical conversion process.

Some common feedstock is used in this process:

Corn

Ethanol

Eucalyptus

Forestry crop residues

Industrial residues

Municipal solid wastes

Palm oil

Sugarcane

Vegetable oil

As you can see, the raw material inputs are varied and come from a wide array of sources, which offers benefits and competitive advantages to the industry. Specifically, because such a large number of inputs are available, the process can be replicated across different markets, landscapes, and geographies.

For example, agriculturally rich countries such as Brazil can process large amounts of agricultural wastes (such as ethanol and sugarcane waste) to generate energy; on the other hand, countries with large industrial apparatuses, such as Russia, can also take advantage of the biomass process by using industrial residues and municipal wastes as primary inputs. The process is thus versatile and scalable, which accounts for its ubiquity in the energy spectrum.

For now, investors have no direct plays into the biomass and biofuels market; in the current industry structure, only privately held companies, municipalities, and other governmental institutions run biomass plants and operations.

However, a company located in Brazil is a world leader in biomass generation: CPFL Energia (CPFL). CPFL generates, distributes, and sells electricity to the Brazilian domestic market. It derives a significant portion of its revenues from biomass generation, specifically the transformation of sugarcane waste into electricity.

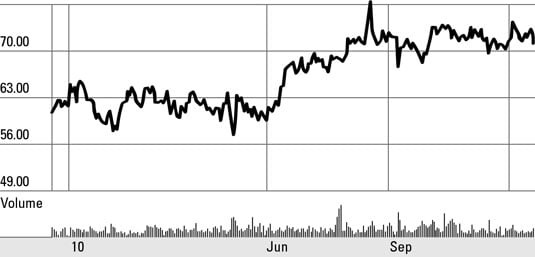

The company trades on the Sao Paulo Stock Exchange (the BOVESPA) but recently listed its shares on the New York Stock Exchange under the ticker CPL, via an American Depository Receipt (ADR).

As a result, you can now get exposure to an exciting market that was nonexistent only a few years ago. More companies involved in the biomass space will likely go public in the coming years, giving you a broader range of options to choose from. In the meantime, monitor CPFL.