About 65 percent of the world stock market is outside of the United States. Should you invest that much of your portfolio in foreign ETFs? No, that may be overdoing it. Approximately 40 to 50 percent of your stock portfolio should be international.

There are six distinct reasons to avoid overloading your portfolio to the tune of 65 percent foreign stocks:

Currency volatility: When you invest abroad, you are usually investing in stocks that are denominated in other currencies. Because your foreign ETFs are denominated in Euros, Yen, or Pounds, they tend to be more volatile than the markets they represent.

In other words, if European stock markets fall and the dollar rises (vis-à-vis the Euro) on the same day, your European ETF will fall doubly hard. If, however, the dollar falls on a day when the sun is shining on European stocks, your European ETF will soar.

Over the long run, individual currencies tend to go up and down. Although it could happen, it is unlikely that the dollar (or Euro) would permanently rise or fall to such a degree that it would seriously affect your nest egg. In the short term, however, such currency fluctuations can be a bit nauseating. See more on currencies in the sidebar “Pure (and purely silly) currency plays.”

Inflation issues: Another risk with going whole hog for foreign stock ETFs is that to a certain extent, your fortunes are tied to those of your home economy.

Stocks tend to do best in a heated economy. But in a heated economy, we also tend to see inflation. Because of that correlation between general price inflation and stock inflation, stock investors are generally able to stay ahead of the inflation game.

If you were to invest all your money in, say, England, and should the economy here take off while the economy there sits idly on the launch pad, you could potentially be rocketed into a Dickensian kind of poverty.

Higher fees for foreign ETFs: In the world of ETFs, the really good buys are to be had on the domestic side of the offerings. For whatever reason, global and international ETFs are about twice the price of broadly diversified U.S. ETFs. For example, while many Vanguard, Schwab, and Fidelity domestic ETFs carry management expenses of 0.10 percent or less, no foreign funds go nearly that low.

An overheated market: It’s possible that international stocks now account for about two-thirds of the world stock market simply because they are overheated. The timing to delve deeply abroad could be all wrong.

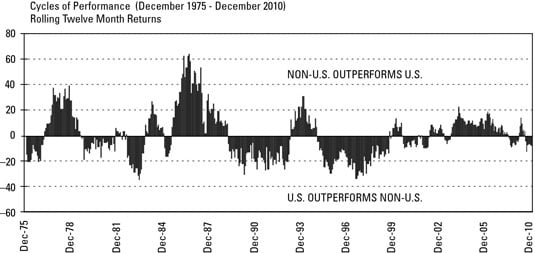

As you see in the hills and valleys, periods in which foreign stocks beat the pants off U.S. stocks are often followed by periods in which those foreign-made pants fall to the ground. We may be on the verge of a U.S. comeback. (And when emerging market stocks fall, they have been known to fall exceptionally hard.)

Lower correlation with homegrown options: Certain kinds of stock funds in the United States offer even lower correlation to the rest of the U.S. market than do many international stock funds, and you should leave room in your portfolio for some of those. You may also want to make room for market-neutral funds.

A double tax hit: Finally, foreign governments almost always hit you up for taxes on any dividends paid by stocks of companies in their countries. You don’t pay this tax directly, but it is taken from your fund holdings.

If your funds are held in certain accounts, Uncle Sam may want your money, too, and you wind up taking a double tax hit. This is a relatively minor reason not to go overboard when sailing overseas.