You can get access to the coal commodities markets either by trading coal futures directly or by investing in coal companies. Here are the details of each option:

Commodities investments in coal futures contracts

As with other members of the fossil fuel family, coal has an underlying futures contract that trades on a commodity exchange — in this case, the Chicago Mercantile Exchange (CME). This coal contract gives commercial users (such as coal producers, electric companies, and steel manufacturers) the opportunity to hedge against market risk and offers speculators a chance to profit from this market risk.

The coal futures contract on the CME tracks the price of the Central Appalachian type of coal. Central Appalachian coal, known as CAPP, is a high-quality coal with low sulfur and ash content.

The CAPP futures contract (which traders sometimes affectionately call “the big sandy” because it’s produced in the area between West Virginia and Kentucky where the Ohio River flows) is the premium benchmark for coal prices in the United States.

The contract trades under the ticker symbol QL and is tradable during all the calendar months of the current year, in addition to all calendar months in the subsequent three years. Additional information on this futures contract is available on the CME website.

Although the coal futures contract does offer you exposure to coal, be warned that the market for this contract is fairly illiquid, meaning that the trading volume is low. Most of the traders involved in this market represent large commercial interests that transact with each other.

A few speculators trade the coal futures markets, but they don’t represent a significant portion of the market. You may not be able to get involved directly in this market without large capital reserves to compete with the commercial interests.

Commodity exposure through coal processing companies

One of the best ways to invest in coal is to invest in a company that mines it. The following three companies are the best:

Arch Coal (NYSE: ACI): Arch Coal is smaller in size than its main competitors, Peabody and Consol, but it’s nice because the coal it produces is of very high quality.

It operates more than 30 mines in the continental U.S. and controls more than 3 billion short tons of reserves. It has operations in the largest coal-producing regions in the United States, including in the Appalachians, the Powder River Basin (on the Montana/Wyoming border), and the Western Bituminous region (on the Colorado/Utah border).

Consol Energy (NYSE: CNX): With headquarters in Pittsburgh, Consol Energy has significant operations in the coal mines of Pennsylvania and nearby coal-rich states of West Virginia and Kentucky. As of 2009, it controlled 8 billion short tons of coal reserves, with operations in more than 17 mines across the United States. CNX is well positioned to take advantage of the booming domestic coal market.

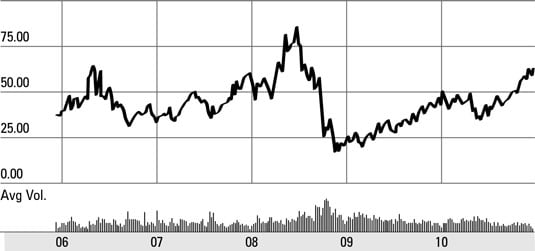

Peabody Energy (NYSE: BTU): Peabody Energy is the largest coal company, with approximately 15 billion short tons of coal reserves. The coal it produces is responsible for generating approximately 10 percent of the electricity in the United States. With 2009 revenues exceeding $5 billion, Peabody Energy is the largest coal company out there today; it’s the ExxonMobil of coal companies.

The company is nice because of its size and because it has mining operations in the United States but also in Australia and Venezuela, two important coal markets.

If you want to invest in coal companies with more international exposure to markets in Russia, China, and other coal-rich countries, consult the World Coal Institute.