Most businesses collect cash as payment for the goods or services they sell. These cash sales must be tracked and recorded in a bookkeeping system. Cash receipts include more than just bills and coins; checks and credit cards also are considered cash sales for the purpose of bookkeeping.

With electronic transaction processing (that’s when a customer’s credit card is swiped through a machine), a deposit is usually made to the business’s checking account that day (sometimes within seconds of the transaction, depending on the type of system the business sets up with the bank).

The only type of payment that doesn’t fall under the umbrella of a cash payment is purchases made on store credit. Store credit refers to credit offered to customers directly by your business rather than through a third party, such as a bank credit card or loan.

Discovering the value of sales receipts

Modern businesses generate sales slips in one of three ways: by the cash register, by the credit card machine, or by hand (written out by the salesperson). Whichever of these three methods you choose to handle your sales transactions, the sales receipt serves two purposes:

Gives the customer proof that the item was purchased on a particular day at a particular price in your store in case he needs to exchange or return the merchandise.

Gives the store a receipt that can be used at a later time to enter the transaction into the company’s books. At the end of the day, the receipts also are used to prove out the cash register and ensure that the cashier has taken in the right amount of cash based on the sales.

To show you how much useable information can be generated for the bookkeeper on a sales receipt here’s a sample receipt from a sale at a bakery:

| Item | Quantity | Price | Total |

|---|---|---|---|

| White Serving Set | 1 | $40 | $40 |

| Cheesecake, Marble | 1 | $20 | $20 |

| Cheesecake, Blueberry | 1 | $20 | $20 |

| $80.00 | |||

| Sales Tax @ 6% | $4.80 | ||

| $84.80 | |||

| Cash Paid | $90.00 | ||

| Change | $5.20 |

Receipts contain a wealth of information that’s collected for your company’s accounting system. A look at a receipt tells you the amount of cash collected, the type of products sold, the quantity of products sold, and how much sales tax was collected.

Unless your company uses some type of computerized system at the point of sale (which is usually the cash register) that’s integrated into the company’s accounting system, sales information is collected throughout the day by the cash register and printed out in a summary form at the end of the day. At that point, you enter the details of the sales day in the books.

If you don’t use your computerized system to monitor inventory, you use the data collected by the cash register to simply enter into the books the cash received, total sales, and sales tax collected. Although in actuality, you’d have many more sales and much higher numbers at the end of the day, here’s what an entry in the Cash Receipts journal would look like for the receipt:

| Debit | Credit | |

|---|---|---|

| Cash in Checking | $84.80 | |

| Sales | $80.00 | |

| Sales Tax Collected | $4.80 |

In this example entry, Cash in Checking is an asset account shown on the balance sheet, and its value increases with the debit. The Sales account is a revenue account on the income statement, and its balanced increases with a Credit, showing additional revenue. The Sales Tax Collected account is a Liability account that appears on the balance sheet; its balance increases with this transaction.

Businesses pay sales tax to state and local government entities either monthly or quarterly depending on rules set by the states, so your business must hold the money owed in a liability account to be certain you’re able to pay the taxes collected from customers when they’re due.

Recording cash transactions in the books

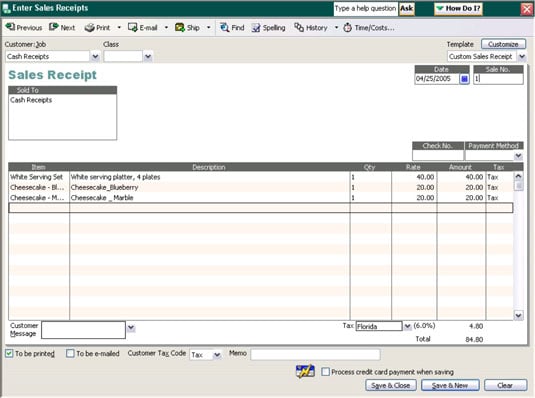

If you’re using a computerized accounting system, you can enter more detail from the day’s receipts and track inventory sold as well. Most of the computerized accounting systems do include the ability to track the sale of inventory. The following figure shows you the QuickBooks Sales receipt form that you can use to input data from each day’s sales.

In addition to the information included in the Cash Receipts journal, note that QuickBooks also collects information about the items sold in each transaction. QuickBooks then automatically updates inventory information, reducing the amount of inventory on hand when necessary. When the inventory number falls below the reorder number you set, QuickBooks alerts you to pass the word on to whoever is responsible for ordering to order more inventory.

If your company accepts credit cards, expect sales revenue to be reduced by the fees paid to credit-card companies. Usually, you face monthly fees as well as fees per transaction; however, each company sets up individual arrangements with its bank regarding these fees. Sales volume impacts how much you pay in fees, so when researching bank services, be sure to compare credit card transaction fees to find a good deal.