The S&P Goldman Sachs Commodity Index (S&P GSCI) is one of the most closely watched indexes in the market. Launched in 1992 by the investment bank Goldman Sachs, it tracks the performance of 24 commodity futures contracts.

In 2007, Standard & Poor’s (S&P) purchased the original GSCI from Goldman Sachs and is now responsible for its operations. The S&P GSCI is the most heavily tracked index. As of 2006, investors had poured in $50 billion to track it; by 2010, that figure was $65 billion.

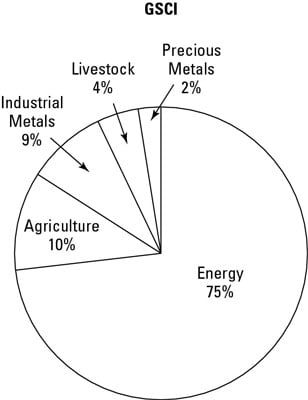

The S&P GSCI is a production-weighted index because it assigns different weights to different commodities proportional to their current global production quantity, a method known as global production weighting. As such, the index assigns more weight to crude oil than cocoa, to reflect actual world production figures — there’s a lot more crude oil produced in the world than cocoa.

Notice that the bulk of the S&P GSCI is tied to energy contracts because energy products dominate global commodity production.

The S&P GSCI is currently overweight energy, but this can always change in the future. If energy production decreases on a global scale, the index will reflect this change. The index reviews its weightings annually and reassigns weights to the index in January.

| Commodity | Exchange | Weight | Commodity | Exchange | Weight |

|---|---|---|---|---|---|

| Chicago wheat | CME | 2.47% | Gas–oil | ICE | 4.41% |

| Kansas wheat | KBOT | 0.90% | Unleaded gas | CME | 7.84% |

| Corn | CME | 2.46% | WTI crude oil | CME | 30.05% |

| Soybeans | CME | 1.77% | Brent crude oil | ICE | 13.81% |

| Coffee | CSC | 0.80% | Natural gas | CME | 10.30% |

| Sugar | CSC | 1.30% | Aluminum | LME | 2.88% |

| Cocoa | CSC | 0.23% | Copper | LME | 2.37% |

| Cotton | NYC | 0.99% | Lead | LME | 0.29% |

| Lean hogs | CME | 2.00% | Nickel | LME | 0.82% |

| Live cattle | CME | 2.88% | Zinc | LME | 0.54% |

| Feeder cattle | CME | 0.78% | Gold | CME | 1.73% |

| Heating oil | CME | 8.16% | Silver | CME | 0.20% |

Because futures contracts have an expiration date, they must be rolled on a regular basis. Contracts such as the crude oil futures are rolled monthly because they expire every month. However, some contracts have contract expiration dates only during certain months of the year. These contracts, such as the contracts for cotton or gold, are rolled according to the available monthly contract trade.

The S&P GSCI has a futures contract that tracks the index’s performance. You can buy this contract on the Chicago Mercantile Exchange (CME). If you have a futures trading account, you can simply buy this contract to get direct access to the S&P GSCI. The ticker symbol for the S&P GSCI on the CME is GI.

Another way to access the S&P GSCI is to invest in a managed fund that tracks its performance. One such fund is the Oppenheimer Real Asset Fund. The Oppenheimer Fund mirrors the performance of the S&P GSCI.

However, as a general rule, managed funds don’t identically replicate the performance of an index because you have to take into consideration external factors such as loads, management fees, and other expenses related to the management of the fund.