The two types of corporate stock ownership are common and preferred. Common stock represents residual ownership in the corporation. Residual ownership consists of any remaining net assets after preferred stockholders’ claims are paid. Preferred stock also shows ownership in the corporation. However, preferred stock contains traits of both debt and equity.

To be a real business, at least one share of common stock has to be issued. After all, somebody has to own the corporation!

Common stockholders elect the board of directors, who oversee the business. The board of directors elects, appoints, or hires the corporate officers (president, vice president, secretary, and treasurer), who handle the day-to-day operations of the business.

Net assets are total assets minus total liabilities.

If a corporation sells its assets and closes its doors, preferred shareholders get back the money they invested in the corporation plus any dividends owed to them, which is money paid the shareholders based on their proportionate stock ownership, before the common stockholders get their piece of the pie.

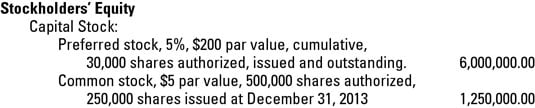

GAAP dictates that you properly describe stock transactions on the balance sheet. Here is the proper balance sheet descriptions for the following common and preferred stock:

Common stock, $5 par value, 500,000 shares authorized, 250,000 shares issued December 31, 2013: The value of the stock in the corporate articles of incorporation is $5 (remember, this is usually an arbitrary number); the total number of shares the corporation can sell at any one time is 500,000; and as of December 31, 2013, 250,000 shares have been sold to investors.

Preferred stock, 5 percent, $200 par value, cumulative, 30,000 shares authorized, issued, and outstanding: Since preferred stock has a debt-like characteristic, the amount of return the corporation has to pay is printed on each share.

In this description, it is 5 percent. The face value per the corporate charter is $200. The limit for the number of shares the corporation can issue at any one time is 30,000. All 30,000 have been sold to investors.