Exchange-Traded Funds, or ETFs, offer many advantages to commodities investors because they offer exposure to asset classes and specific investments that would otherwise be difficult for the average investor to access, such as uranium or palladium.

In addition, they give you a broad diversification platform because they can track a basket of stocks or commodities. This characteristic is a major reason ETFs have become so popular in the last decade, increasing from several dozen to more than 2,500 ETF products.

Unlike a regular mutual fund, in which the net asset value is generally calculated at the end of the trading day, the ETF enables you to trade throughout the day. Furthermore, you can go both long and short the ETF, something you can’t do with regular mutual funds.

It’s critical to perform extensive due diligence on any ETF product you’re considering for your portfolio. You need a solid understanding of the underlying assets in the ETF. Often beginning investors simply browse the description without getting a good grip on what they’re actually buying. For example, the current uranium ETF URA (NYSE: URA) isn’t a product that tracks uranium metal prices; it tracks a basket of uranium-mining equities.

Folks who don’t get into the fine print may miss basic yet critical pieces of information regarding ETFs specifically and broader investment products in general. Make sure you go beyond the headlines and into the fine print!

ETFs aren’t free, in the sense that they’re actively managed products associated with a financial institution. ETF sponsors generally charge an added layer of fees for the convenience of using their products. Therefore, it’s imperative to know the types of fees associated with each ETF you purchase. This information is conveniently located in the fund’s prospectus.

Deutsche Bank launched the first commodity index ETF in the United States in February 2006. The Deutsche Bank Commodity Index Tracking Fund (AMEX: DBC) is listed on the American Stock and Options Exchange (AMEX) and tracks the Deutsche Bank Liquid Commodity Index (DBLCI). The DBLCI, in turn, tracks a basket of six liquid commodities:

Light, sweet crude oil (35 percent)

Heating oil (20 percent)

Aluminum (12.5 percent)

Corn (11.25 percent)

Wheat (11.25 percent)

Gold (10 percent)

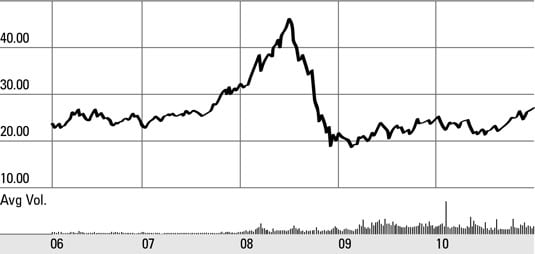

Clearly, the DBC is a superb indicator of the broader commodity markets. The story of commodities since 2005 is characterized by a massive run-up in prices, driven partly by large consumption demands from emerging markets such as China and by speculative activity. That price run-up resulted in a massive bursting of asset bubbles in 2008 during the Global Financial Crisis.

Commodities, like almost every other tradable asset class, suffered a shocking downward dislocation when liquidity dried up; the DBC accurately portrays this turn of events.

The DBC ETF is structured as a commodity pool operator (CPO), and the fund invests directly in commodity futures contracts. To capture additional yields, the energy contracts are rolled monthly; the rest of the contracts are rolled annually. The fund also invests in fixed-income products, including the three-month Treasury bill, which provides an additional yield for investors. With an expense ratio of 1.5 percent, it’s a reasonably priced investment.