In the past century, small cap stocks and the ETFs based on them have outperformed large cap stocks. The volatility of small cap has also been greater. In terms of return per unit of risk (risk-adjusted rate of return), however, small caps are clearly winners. And so it would seem that investing in small caps is a pretty smart thing to do. But not all small caps are created equal.

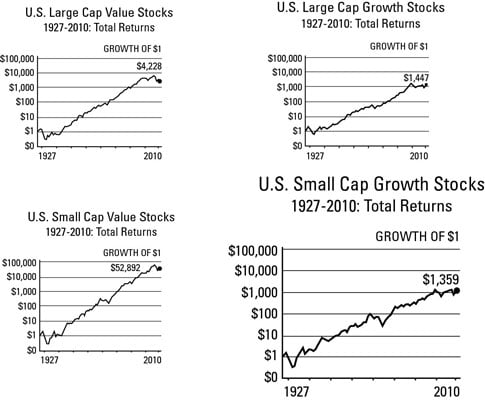

As it happens, the true stars of the small cap world have been small cap value stocks rather than small cap growth stocks. How slow-growing, often ailing companies have beat out their hot-to-trot cousins remains one of the great unresolved mysteries of the investing world. But the numbers don’t lie.

In fact, if you look at the numbers you may be inclined to treat small growth stocks as a pariah. Please don’t. They belong in a well-diversified portfolio. Some years are clearly small growth years.

The best example is rather recent: About midway through 2011, small cap growth stocks have seen a 12-month return of more than 30 percent, beating both small value and large caps by a very wide margin. Back in 2003, small growth was the undisputed King of Returns, clocking in at an astounding 50.37 percent.

Who is to say that the long-term past wasn’t a fluke and that small growth may actually go on to outperform all other asset classes in the next 20 years?